- Total economic losses from disaster events reached USD 37 billion in H1 2015

- Insured losses from disaster events were USD 16.5 billion in H1 2015

- Natural catastrophe-related insurance claims were USD 12.9 billion in the first six months of the year

- 18 000 lives were lost as a result of natural catastrophes and man-made disasters in H1 2015

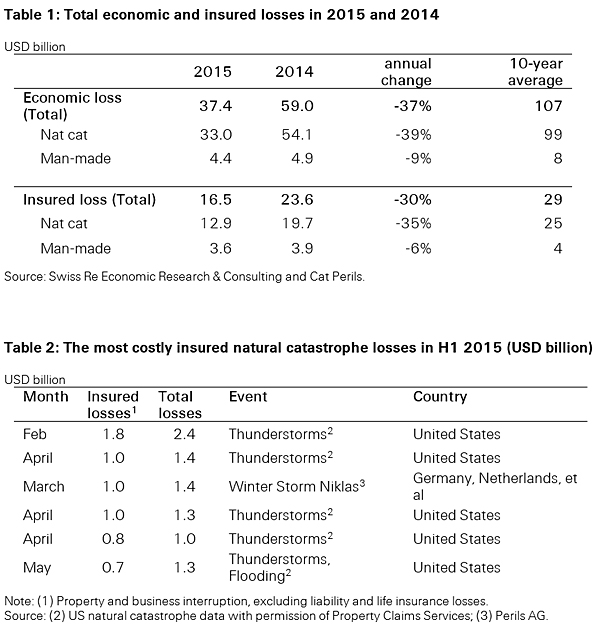

ZURICH, 11-8-2015 — /EuropaWire/ — According to preliminary sigma estimates, total economic losses from natural catastrophes and man-made disasters reached USD 37 billion in the first half of 2015. The global insurance industry covered nearly 45% (USD 16.5 billion) of these losses, which is higher than the previous 10-year average cover of 27%. Around 18 000 people lost their lives in disaster events in H1 2015, up from more than 4 800 in the first half of last year. The earthquakes in Nepal, and a heatwave in India and Pakistan, claimed the highest number of victims.

Natural catastrophes caused total economic losses of USD 33 billion in the first half of the year, well below the USD 54 billion in H1 2014 and also the average first-half year loss over the previous 10 years (USD 99 billion). Of the overall insured losses, USD 12.9 billion came from natural disasters, down from nearly USD 20 billion in H1 2014 and again below the average first-half year loss of the previous 10 years (USD 25 billion). The costliest natural catastrophes for the insurance industry resulted from severe winter weather and thunderstorms in the US and Europe. In February, a winter storm in the northeastern US caused insurance losses of USD 1.8 billion, the highest loss of any event so far this year. Man-made disasters, meanwhile, triggered an additional USD 3.6 billion in overall insurance losses in H1 2015.

Earthquakes and soaring temperatures claim thousands of lives

Disaster events claimed many lives in the first six months of 2015. In all, around 18 000 people lost their lives. There were more than 9 000 fatalities in the earthquakes that struck Nepal in close succession in April and May, the largest loss of life due to any natural catastrophes so far this year. The quakes also left many people homeless. The economic losses in Nepal are estimated to be more than USD 5 billion. Of those, only around USD 160 million were insured losses.[1]

“The tragic events in Nepal are a reminder of the utility of insurance,” says Kurt Karl, Chief Economist at Swiss Re. “Insurance cover does not lessen the emotional trauma that natural catastrophes inflict, but it can help people better manage the financial fallout from disasters so they can start to rebuild their lives”.

In the same region, India and Pakistan were hit by a severe heat wave in May and June. Temperatures soared to 48°C, the highest recorded since 1995. It is estimated that more than 2 500 people died in India and 1 500 in Pakistan as a result of the extreme heat.

Another factor in the high number of victims of disaster events in the first half of this year is the number of migrants who have died attempting to reach Europe from conflict zones in northern Africa, often in unseaworthy vessels. In search of a better life, sadly these people have instead lost their lives as the boats capsized while carrying them across the Mediterranean.

[1] The insured loss estimate for the Nepal earthquakes is subject to change.

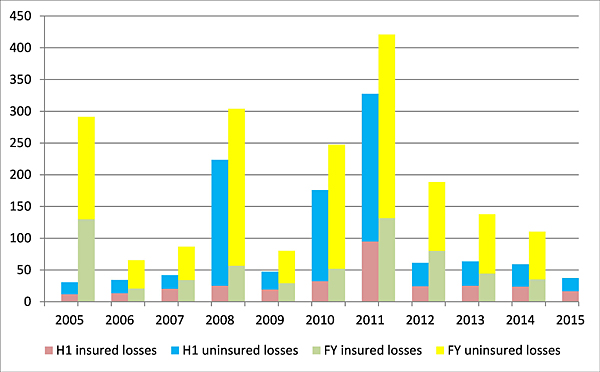

Figure 1: Catastrophe-related losses (USD billion)

Note: insured losses + uninsured losses= total economic losses

Source: Swiss Re Economic Research & Consulting and Cat Perils.

The estimates in this release include all latest updates to source data made by 6 August 2015.

Notes to editors

Swiss Re

The Swiss Re Group is a leading wholesale provider of reinsurance, insurance and other insurance-based forms of risk transfer. Dealing direct and working through brokers, its global client base consists of insurance companies, mid-to-large-sized corporations and public sector clients. From standard products to tailor-made coverage across all lines of business, Swiss Re deploys its capital strength, expertise and innovation power to enable the risk-taking upon which enterprise and progress in society depend. Founded in Zurich, Switzerland, in 1863, Swiss Re serves clients through a network of around 70 offices globally and is rated “AA-” by Standard & Poor’s, “Aa3” by Moody’s and “A+” by A.M. Best. Registered shares in the Swiss Re Group holding company, Swiss Re Ltd, are listed in accordance with the Main Standard on the SIX Swiss Exchange and trade under the symbol SREN. For more information about Swiss Re Group, please visit: www.swissre.com or follow us on Twitter @SwissRe.

Accessing data by sigma:

The data from the study can be accessed and visualised at www.sigma-explorer.com. This mobile enabled web-application allows users to create charts, share them via social media and export them as standard graphic files.

MEDIA RELATIONS, ZURICH

T +41 43 285 7171

Send an e-mail

- Astor Asset Management 3 Ltd: Salinas Pliego Incumple Préstamo de $110 Millones USD y Viola Regulaciones Mexicanas

- Astor Asset Management 3 Ltd: Salinas Pliego Verstößt gegen Darlehensvertrag über 110 Mio. USD und Mexikanische Wertpapiergesetze

- ChargeEuropa zamyka rundę finansowania, której przewodził fundusz Shift4Good tym samym dokonując historycznej francuskiej inwestycji w polski sektor elektromobilności

- Strengthening EU Protections: Robert Szustkowski calls for safeguarding EU citizens’ rights to dignity

- Digi Communications NV announces the release of H1 2024 Financial Results

- Digi Communications N.V. announces that conditional stock options were granted to a director of the Company’s Romanian Subsidiary

- Digi Communications N.V. announces Investors Call for the presentation of the H1 2024 Financial Results

- Digi Communications N.V. announces the conclusion of a share purchase agreement by its subsidiary in Portugal

- Digi Communications N.V. Announces Rating Assigned by Fitch Ratings to Digi Communications N.V.

- Digi Communications N.V. announces significant agreements concluded by the Company’s subsidiaries in Spain

- SGW Global Appoints Telcomdis as the Official European Distributor for Motorola Nursery and Motorola Sound Products

- Digi Communications N.V. announces the availability of the instruction regarding the payment of share dividend for the 2023 financial year

- Digi Communications N.V. announces the exercise of conditional share options by the executive directors of the Company, for the year 2023, as approved by the Company’s Ordinary General Shareholders’ Meetings from 18th May 2021 and 28th December 2022

- Digi Communications N.V. announces the granting of conditional stock options to Executive Directors of the Company based on the general shareholders’ meeting approval from 25 June 2024

- Digi Communications N.V. announces the OGMS resolutions and the availability of the approved 2023 Annual Report

- Czech Composer Tatiana Mikova Presents Her String Quartet ‘In Modo Lidico’ at Carnegie Hall

- SWIFTT: A Copernicus-based forest management tool to map, mitigate, and prevent the main threats to EU forests

- WickedBet Unveils Exciting Euro 2024 Promotion with Boosted Odds

- Museum of Unrest: a new space for activism, art and design

- Digi Communications N.V. announces the conclusion of a Senior Facility Agreement by companies within Digi Group

- Digi Communications N.V. announces the agreements concluded by Digi Romania (formerly named RCS & RDS S.A.), the Romanian subsidiary of the Company

- Green Light for Henri Hotel, Restaurants and Shops in the “Alter Fischereihafen” (Old Fishing Port) in Cuxhaven, opening Summer 2026

- Digi Communications N.V. reports consolidated revenues and other income of EUR 447 million, adjusted EBITDA (excluding IFRS 16) of EUR 140 million for Q1 2024

- Digi Communications announces the conclusion of Facilities Agreements by companies from Digi Group

- Digi Communications N.V. Announces the convocation of the Company’s general shareholders meeting for 25 June 2024 for the approval of, among others, the 2023 Annual Report

- Digi Communications NV announces Investors Call for the presentation of the Q1 2024 Financial Results

- Digi Communications intends to propose to shareholders the distribution of dividends for the fiscal year 2023 at the upcoming General Meeting of Shareholders, which shall take place in June 2024

- Digi Communications N.V. announces the availability of the Romanian version of the 2023 Annual Report

- Digi Communications N.V. announces the availability of the 2023 Annual Report

- International Airlines Group adopts Airline Economics by Skailark ↗️

- BevZero Spain Enhances Sustainability Efforts with Installation of Solar Panels at Production Facility

- Digi Communications N.V. announces share transaction made by an Executive Director of the Company with class B shares

- BevZero South Africa Achieves FSSC 22000 Food Safety Certification

- Digi Communications N.V.: Digi Spain Enters Agreement to Sell FTTH Network to International Investors for Up to EUR 750 Million

- Patients as Partners® Europe Announces the Launch of 8th Annual Meeting with 2024 Keynotes and Topics

- driveMybox continues its international expansion: Hungary as a new strategic location

- Monesave introduces Socialised budgeting: Meet the app quietly revolutionising how users budget

- Digi Communications NV announces the release of the 2023 Preliminary Financial Results

- Digi Communications NV announces Investors Call for the presentation of the 2023 Preliminary Financial Results

- Lensa, един от най-ценените търговци на оптика в Румъния, пристига в България. Първият шоурум е открит в София

- Criando o futuro: desenvolvimento da AENO no mercado de consumo em Portugal

- Digi Communications N.V. Announces the release of the Financial Calendar for 2024

- Customer Data Platform Industry Attracts New Participants: CDP Institute Report

- eCarsTrade annonce Dirk Van Roost au poste de Directeur Administratif et Financier: une décision stratégique pour la croissance à venir

- BevZero Announces Strategic Partnership with TOMSA Desil to Distribute equipment for sustainability in the wine industry, as well as the development of Next-Gen Dealcoholization technology

- Digi Communications N.V. announces share transaction made by a Non-Executive Director of the Company with class B shares

- Digi Spain Telecom, the subsidiary of Digi Communications NV in Spain, has concluded a spectrum transfer agreement for the purchase of spectrum licenses

- Эксперт по торговле акциями Сергей Левин запускает онлайн-мастер-класс по торговле сырьевыми товарами и хеджированию

- Digi Communications N.V. announces the conclusion by Company’s Portuguese subsidiary of a framework agreement for spectrum usage rights

- North Texas Couple Completes Dream Purchase of Ouray’s Iconic Beaumont Hotel

- Предприниматель и филантроп Михаил Пелег подчеркнул важность саммита ООН по Целям устойчивого развития 2023 года в Нью-Йорке

- Digi Communications NV announces the release of the Q3 2023 Financial Results

- IQ Biozoom Innovates Non-Invasive Self-Testing, Empowering People to Self-Monitor with Laboratory Precision at Home

- BevZero Introduces Energy Saving Tank Insulation System to Europe under name “BevClad”

- Motorvision Group reduces localization costs using AI dubbing thanks to partnering with Dubformer

- Digi Communications NV Announces Investors Call for the Q3 2023 Financial Results

- Jifiti Granted Electronic Money Institution (EMI) License in Europe

- Предприниматель Михаил Пелег выступил в защиту образования и грамотности на мероприятии ЮНЕСКО, посвящённом Международному дню грамотности

- VRG Components Welcomes New Austrian Independent Agent

- Digi Communications N.V. announces that Digi Spain Telecom S.L.U., its subsidiary in Spain, and abrdn plc have completed the first investment within the transaction having as subject matter the financing of the roll out of a Fibre-to-the-Home (“FTTH”) network in Andalusia, Spain

- Продюсер Михаил Пелег, как сообщается, работает над новым сериалом с участием крупной голливудской актрисы

- Double digit growth in global hospitality industry for Q4 2023

- ITC Deploys Traffic Management Solution in Peachtree Corners, Launches into United States Market

- Cyviz onthult nieuwe TEMPEST dynamische controlekamer in Benelux, Nederland

- EU-Funded CommuniCity Launches its Second Open Call

- Astrologia pode dar pistas sobre a separação de Sophie Turner e Joe Jonas

- La astrología puede señalar las razones de la separación de Sophie Turner y Joe Jonas

- Empowering Europe against infectious diseases: innovative framework to tackle climate-driven health risks

- Montachem International Enters Compostable Materials Market with Seaweed Resins Company Loliware

- Digi Communications N.V. announces that its Belgian affiliated companies are moving ahead with their operations

- Digi Communications N.V. announces the exercise of conditional share options by an executive director of the Company, for the year 2022, as approved by the Company’s Ordinary General Shareholders’ Meeting from 18 May 2021

- Digi Communications N.V. announces the availability of the instruction regarding the payment of share dividend for the 2022 financial year

- Digi Communications N.V. announces the availability of the 2022 Annual Report

- Digi Communications N.V. announces the general shareholders’ meeting resolutions from 18 August 2023 approving amongst others, the 2022 Annual Accounts

- Русские эмигранты усиливают призывы «Я хочу, чтобы вы жили» через искусство

- BevZero Introduces State-of-the-Art Mobile Flash Pasteurization Unit to Enhance Non-Alcoholic Beverage Stability at South Africa Facility

- Russian Emigrés Amplify Pleas of “I Want You to Live” through Art

- Digi Communications NV announces the release of H1 2023 Financial Results

- Digi Communications NV Announces Investors Call for the H1 2023 Financial Results

- Digi Communications N.V. announces the convocation of the Company’s general shareholders meeting for 18 August 2023 for the approval of, among others, the 2022 Annual Report

- “Art Is Our Weapon”: Artists in Exile Deploy Their Talents in Support of Peace, Justice for Ukraine

- Digi Communications N.V. announces the availability of the 2022 Annual Financial Report

- “AmsEindShuttle” nuevo servicio de transporte que conecta el aeropuerto de Eindhoven y Ámsterdam

- Un nuovo servizio navetta “AmsEindShuttle” collega l’aeroporto di Eindhoven ad Amsterdam

- Digi Communications N.V. announces the conclusion of an amendment agreement to the Facility Agreement dated 26 July 2021, by the Company’s Spanish subsidiary

- Digi Communications N.V. announces an amendment of the Company’s 2023 financial calendar

- iGulu F1: Brewing Evolution Unleashed

- Почему интерактивная «Карта мира» собрала ключевые антивоенные сообщества россиян по всему миру и становится для них важнейшим инструментом

- Hajj Minister meets EU ambassadors to Saudi Arabia

- Online Organizing Platform “Map of Peace” Emerges as Key Tool for Diaspora Activists

- Digi Communications N.V. announces that conditional stock options were granted to executive directors of the Company based on the general shareholders’ meeting approval from 18 May 2021

- Digi Communications N.V. announces the release of the Q1 2023 financial results

- AMBROSIA – A MULTIPLEXED PLASMO-PHOTONIC BIOSENSING PLATFORM FOR RAPID AND INTELLIGENT SEPSIS DIAGNOSIS AT THE POINT-OF-CARE

- Digi Communications NV announces Investors Call for the Q1 2023 Financial Results presentation

- Digi Communications N.V. announces the amendment of the Company’s 2023 financial calendar

- Digi Communications N.V. announces the conclusion of two Facilities Agreements by the Company’s Romanian subsidiary

- Digi Communications N.V. announces the conclusion of a Senior Facility Agreement by the Company’s Romanian subsidiary

- Patients as Partners Europe Returns to London and Announces Agenda Highlights

- GRETE PROJECT RESULTS PRESENTED TO TEXTILE INDUSTRY STAKEHOLDERS AT INTERNATIONAL CELLULOSE FIBRES CONFERENCE

- Digi Communications N.V. announces Digi Spain Telecom S.L.U., its subsidiary in Spain, entered into an investment agreement with abrdn to finance the roll out of a Fibre-to-the-Home (FTTH) network in Andalusia, Spain

- XSpline SPA / University of Linz (Austria): the first patient has been enrolled in the international multicenter clinical study for the Cardiac Resynchronization Therapy DeliveRy guided by non-Invasive electrical and VEnous anatomy assessment (CRT-DRIVE)

- Franklin Junction Expands Host Kitchen® Network To Europe with Digital Food Hall Pioneer Casper

- Unihertz a dévoilé un nouveau smartphone distinctif, Luna, au MWC 2023 de Barcelone

- Unihertz Brachte ein Neues, Markantes Smartphone, Luna, auf dem MWC 2023 in Barcelona

- Editor's pick archive....