https://youtu.be/5sBAViKizc4

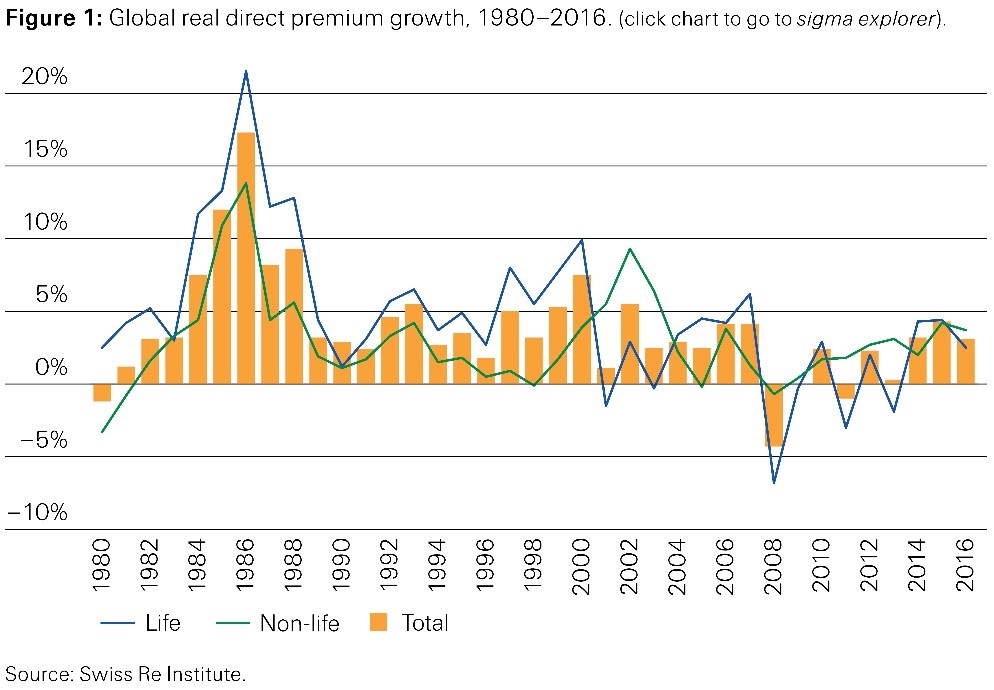

- Global insurance premiums increased by 3.1% in 2016; down from 4.3% growth in 2015.

- Life premium growth slowed to 2.5% and non-life to 3.7% in 2016, due to weaker performance in advanced markets

- Profitability in the life and non-life sectors weakened amid low interest rates and robust competition

- Life and non-life premiums in China grew very strongly, but many other emerging markets were in slowdown mode

- Emerging markets to continue to drive global premium growth; stronger activity in advanced economies to boost non-life sector

- Special chapter says digital distribution in insurance is growing, but agents and brokers will continue to play an important role

ZURICH, 06-Jul-2017 — /EuropaWire/ — Global insurance premiums increased by 3.1% in real terms in 2016, a fairly solid outcome in an environment of moderate global economic growth, Swiss Re Institute’s latest sigma report says. The main cause of the weaker global premium development compared to 2015 were the advanced economies but growth in many emerging markets – excluding China – slowed also. Global life premium growth slowed to 2.5% in 2016 from 4.4% in 2015 as advanced market premiums contracted, while life premiums in the emerging regions together grew by more than double the long-term average. On the non-life side, global premiums grew 3.7% in 2016, reflecting relatively solid expansion among the emerging countries and another exceptional performance in China. The emerging markets will likely fuel improvement in life premiums in the coming years, with China and India being the main growth drivers. Non-life premium growth is expected to remain moderate, with stronger economic activity in the advanced markets supporting momentum.

Total direct insurance premiums written grew by 3.1% in real terms in 2016, down from 4.3% growth in 2015. The increase in 2016 came despite global economic growth – a key driver of insurance demand – of just 2.5%. In nominal USD terms, global insurance premiums were up 2.9%. Nominal growth was lower than real due to currency depreciations, particularly in the UK and some emerging countries.

The China growth engine steams ahead, in life and non-life sectors

Global direct life insurance premiums totalled USD 2 617 billion in 2016, up 2.5% in real terms. This was slower than the 4.4% expansion in 2015 but still above the 10-year average of 1.1% growth. Emerging markets remained the main source of global growth, with premiums up 17%, more than twice the 10-year average of 8.4%, and primarily driven by rapid growth in China. “The life sector in China is growing very rapidly,” says Kurt Karl, Chief Economist at Swiss Re. “Sales of traditional life products were very strong in 2016, benefitting from further liberalisation of interest rates and government efforts to encourage growth of protection products.”

Excluding China, overall emerging market life premium growth was significantly lower but still a hearty 5.7%, driven by gains in India, Indonesia and Vietnam. It was a different story in the advanced markets, where premiums contracted by 0.5% in 2016, extending a 10-year period of stagnation in premium development.

In non-life, global premiums grew by 3.7% in 2016, down from the 4.2% gain in 2015 but more than the 10-year average of 2.0%. Once again, premium growth in the emerging markets was solid at 9.6%, above the 10-year average of 8.3%. However, the emerging market outcome was heavily skewed by China, where non-life premiums were up 20%.

A surge in demand for health insurance and sustained but slowing demand in motor insurance underpinned non-life premiums in China. Excluding China, emerging market premiums overall increased by just 1.7%. Non-life premium growth in the advanced markets slowed to 2.3% in 2016 (2015: 3.3%), but that was well above the 10-year average of 1.0%. Growth weakened in all major advanced regions (except Oceania) due to lower economic growth and softer rates.

China is the world’s number three insurance market

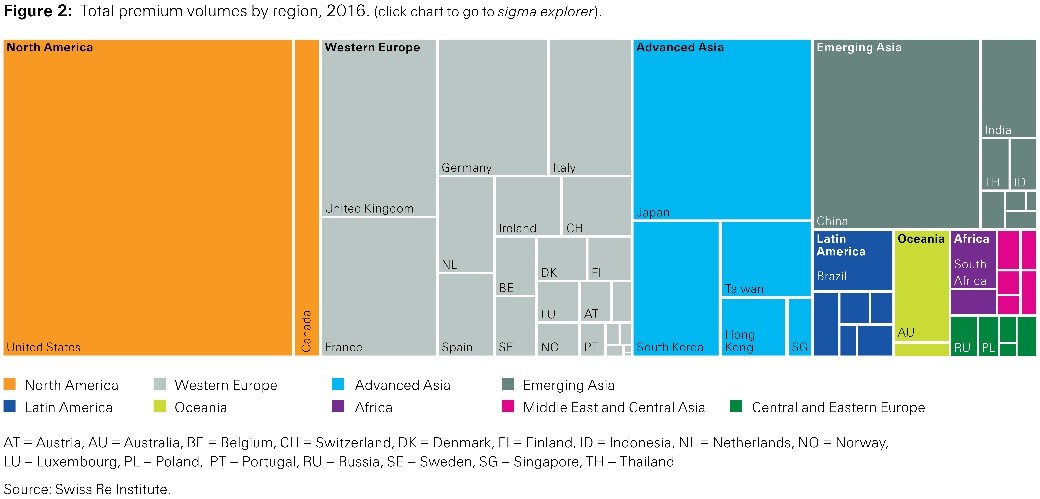

In 2000, China was the 16th largest market globally in terms of total insurance premiums written. By 2016, it was the world’s third largest market with USD 466 billion in total premiums, not much smaller than the second largest market, Japan (USD 471 billion), but still much smaller than the US (USD 1.35 trillion). The interactive infographic below tracks China’s development to its position as world number 3, which it has held since 2015.

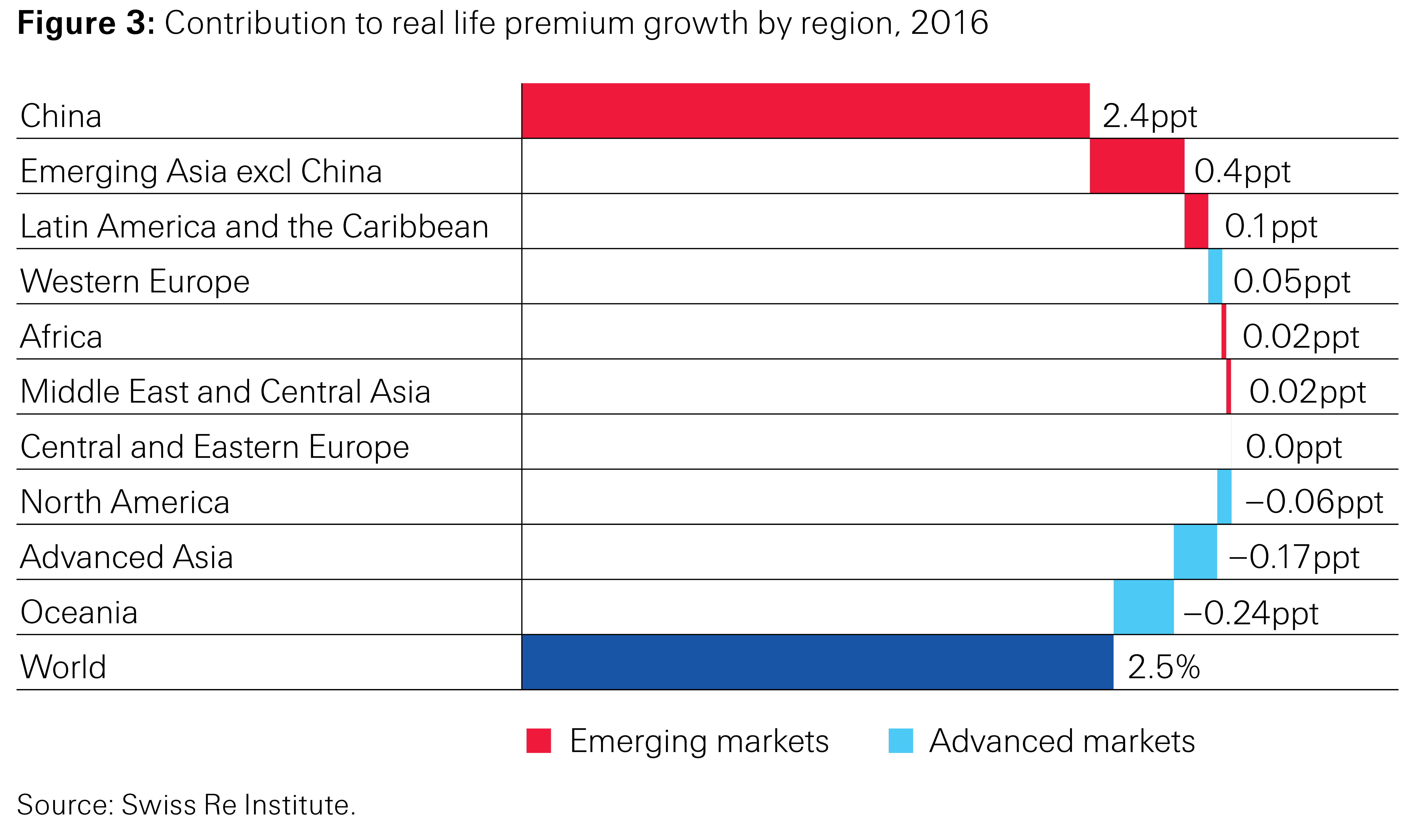

In life insurance, China was the most important source of premium growth in 2016. It contributed 2.4 percentage points (ppt) of the global 2.5% growth in sector premiums last year. All other markets combined were responsible for the remaining 0.1 ppt (see Figure 3). In non-life, regional/country contributions were more balanced. For example, despite much stronger premium growth rates in China in 2016, the advanced markets continued to play a major role in the global market. Together, North America and Western Europe contributed 1.8 ppt of the 3.7% growth in global sector, and China 1.7 ppt.

Low interest rates continue to pressure profits

With still low interest rates, profitability in the insurance industry remains under pressure, and return on equity (ROE) declined in both sectors in 2016. In life, moderate premium growth in many markets also dragged on profitability, while the non-life sector was further impacted by lower underwriting results. In the US, the non-life sector experienced its first underwriting loss in four years, driven by higher catastrophe losses and lower releases from prior-year loss reserves. Despite pressure on profits, however, both the life and non-life insurance sectors remain well capitalised.

Premium growth likely to improve, but profits to remain under pressure

Global life premium growth is expected to improve in the coming years, mainly driven by the emerging markets, in particular China and India. Advanced markets should also grow, but only moderately. While North America is expected to outperform Western Europe, growth will likely be highest in advanced Asia. Growth in global non-life is expected to remain moderate, with stronger activity in the advanced economies lending support. Premium growth is expected to improve in North America and advanced Asia, but remain flat in Western Europe and Oceania. Emerging markets are likely to grow robustly but at a slower pace than in the recent past. There will be healthy growth in China and to a lesser extent in India.

Managing legacy savings business with embedded guarantees will remain a major challenge for life insurers’ profitability in the coming years. Historically-low interest rates are likely to persist and limit the ability to offer attractive savings products to boost new business. Life insurers will continue to re-orientate their business models and shift their focus from traditional savings to life protection products, but it will be a while before these measures have an impact. The profitability of non-life insurers is expected to remain pressured given still-low investment returns, and as underwriting results are impacted by the continued soft market conditions and dwindling reserve releases.

Digital distribution continues to grow; intermediaries are here to stay

This sigma includes a special chapter on developments in digital distribution in insurance. There has been a proliferation of direct digital distribution channels in recent years, in some markets. At the same time, the share of traditionally intermediated insurance business remains dominant globally. The digitalisation of insurance distribution is set to continue, but the pace of change will vary across markets. Digital channels will ultimately be used throughout the distribution process, from information gathering to purchase completion to after-sales service. But not all insurance transactions will migrate to online, and intermediaries will continue to play an important role.

NOTES TO EDITORS

Swiss Re

The Swiss Re Group is a leading wholesale provider of reinsurance, insurance and other insurance-based forms of risk transfer. Dealing direct and working through brokers, its global client base consists of insurance companies, mid-to-large-sized corporations and public sector clients. From standard products to tailor-made coverage across all lines of business, Swiss Re deploys its capital strength, expertise and innovation power to enable the risk-taking upon which enterprise and progress in society depend. Founded in Zurich, Switzerland, in 1863, Swiss Re serves clients through a network of around 80 offices globally and is rated “AA-” by Standard & Poor’s, “Aa3” by Moody’s and “A+” by A.M. Best. Registered shares in the Swiss Re Group holding company, Swiss Re Ltd, are listed in accordance with the International Reporting Standard on the SIX Swiss Exchange and trade under the symbol SREN. For more information about Swiss Re Group, please visit: www.swissre.com or follow us on Twitter @SwissRe.

Accessing data by sigma:

The data from the study can be accessed and visualised at www.sigma-explorer.com. This mobile enable web-application allows users to create charts, share them via social media and export them as standard graphic files.

How to order this sigma study:

The English, German, French, and Spanish versions of the sigma No 3 /2017, World insurance in 2016: the China growth engine steams ahead are available electronically on Swiss Re’s website: www.swissre.com/sigma

Printed editions of sigma No 3/2017 in English, German, French and Spanish are available. The printed versions in Chinese and Japanese will be available in the near future. Please send your orders, complete with your full postal address, to sigma@swissre.com

SOURCE: Swiss Re

MEDIA RELATIONS

Hotline +41 43 285 7171

E-mail: Media_Relations@swissre.com

- Digi Communications N.V. announces Capital Markets Day 2026

- Digi Communications N.V. announces Convening of the Company’s general shareholders extraordinary meeting for 20 March 2026, for the approval of, among others, the authorization of the Board of Directors to issue shares

- EPP Pricing Platform announces leadership transition to support long-term continuity and growth

- BEISPIELLOSER SCHRITT: ZEE ENTERTAINMENT UK STARTET SEIN FLAGGSCHIFF ZEE TV MIT LIVE-UNTERTITELN IN DEUTSCHER SPRACHE AUF SAMSUNG TV PLUS IN DEUTSCHLAND, ÖSTERREICH UND DER SCHWEIZ

- Netmore Acquires Actility to Lead Global Transformation of Massive IoT

- Digi Communications N.V. announces the release of 2026 Financial Calendar

- Digi Communications N.V. announces availability of the report on corporate income tax information for the financial year ending December 31, 2024

- Oznámení o nadcházejícím vyhlášení rozsudku Evropského soudu pro lidská práva proti České republice ve čtvrtek dne 18. prosince 2025 ve věci důvěrnosti komunikace mezi advokátem a jeho klientem

- TrustED kicks off pilot phase following a productive meeting in Rome

- Gstarsoft consolida su presencia europea con una participación estratégica en BIM World Munich y refuerza su compromiso a largo plazo con la transformación digital del sector AEC

- Gstarsoft conforte sa présence européenne avec une participation dynamique à BIM World Munich et renforce son engagement à long terme auprès de ses clients

- Gstarsoft stärkt seine Präsenz in Europa mit einem dynamischen Auftritt auf der BIM World Munich und bekräftigt sein langfristiges Engagement für seine Kunden

- Digi Communications N.V. announces Bucharest Court of Appeal issued a first instance decision acquitting Digi Romania S.A., its current and former directors, as well as the other parties involved in the criminal case which was the subject matter of the investigation conducted by the Romanian National Anticorruption Directorate

- Digi Communications N.V. announces the release of the Q3 2025 financial report

- Digi Communications N.V. announces the admission to trading on the regulated market operated by Euronext Dublin of the offering of senior secured notes by Digi Romania

- Digi Communications NV announces Investors Call for the presentation of the Q3 2025 Financial Results

- Rise Point Capital invests in Run2Day; Robbert Cornelissen appointed CEO and shareholder

- Digi Communications N.V. announces the successful closing of the offering of senior secured notes due 2031 by Digi Romania

- BioNet Achieves EU-GMP Certification for its Pertussis Vaccine

- Digi Communications N.V. announces the upsize and successful pricing of the offering of senior secured notes by Digi Romania

- Hidora redéfinit la souveraineté du cloud avec Hikube : la première plateforme cloud 100% Suisse à réplication automatique sur trois data centers

- Digi Communications N.V. announces launch of senior secured notes offering by Digi Romania. Conditional full redemption of all outstanding 2028 Notes issued on 5 February 2020

- China National Tourist Office in Los Angeles Spearheads China Showcase at IMEX America 2025 ↗️

- China National Tourist Office in Los Angeles Showcases Mid-Autumn Festival in Arcadia, California Celebration ↗️

- Myeloid Therapeutics Rebrands as CREATE Medicines, Focused on Transforming Immunotherapy Through RNA-Based In Vivo Multi-Immune Programming

- BevZero South Africa Invests in Advanced Paarl Facility to Drive Quality and Innovation in Dealcoholized Wines

- Plus qu’un an ! Les préparatifs pour la 48ème édition des WorldSkills battent leur plein

- Digi Communications N.V. announces successful completion of the FTTH network investment in Andalusia, Spain

- Digi Communications N.V. announces Completion of the Transaction regarding the acquisition of Telekom Romania Mobile Communications’ prepaid business and certain assets

- Sparkoz concludes successful participation at CMS Berlin 2025

- Digi Communications N.V. announces signing of the business and asset transfer agreement between DIGI Romania, Vodafone Romania, Telekom Romania Mobile Communications, and Hellenic Telecommunications Organization

- Sparkoz to showcase next-generation autonomous cleaning robots at CMS Berlin 2025

- Digi Communications N.V. announces clarifications on recent press articles regarding Digi Spain S.L.U.

- Netmore Assumes Commercial Operations of American Tower LoRaWAN Network in Brazil in Strategic Transition

- Cabbidder launches to make UK airport transfers and long-distance taxi journeys cheaper and easier for customers ↗️

- Robert Szustkowski appeals to the Prime Minister of Poland for protection amid a wave of hate speech

- Digi Communications NV announces the release of H1 2025 Financial Report

- Digi Communications NV announces “Investors Call for the presentation of the H1 2025 Financial Results”

- As Brands React to US Tariffs, CommerceIQ Offers Data-Driven Insights for Expansion Into European Markets

- Digi Communications N.V. announces „The Competition Council approves the acquisition of the assets and of the shares of Telekom Romania Mobile Communications by DIGI Romania and Vodafone Romania”

- HTR makes available engineering models of full-metal elastic Lunar wheels

- Tribunal de EE.UU. advierte a Ricardo Salinas: cumpla o enfrentará multas y cárcel por desacatoo

- Digi Communications N.V. announces corporate restructuring of Digi Group’s affiliated companies in Belgium

- Aortic Aneurysms: EU-funded Pandora Project Brings In-Silico Modelling to Aid Surgeons

- BREAKING NEWS: New Podcast “Spreading the Good BUZZ” Hosted by Josh and Heidi Case Launches July 7th with Explosive Global Reach and a Mission to Transform Lives Through Hope and Community in Recovery

- Cha Cha Cha kohtub krüptomaailmaga: Winz.io teeb koostööd Euroopa visionääri ja staari Käärijäga

- Digi Communications N.V. announces Conditional stock options granted to Executive Directors of the Company, for the year 2025, based on the general shareholders’ meeting approval from 25 June 20244

- Cha Cha Cha meets crypto: Winz.io partners with European visionary star Käärijä

- Digi Communications N.V. announces the exercise of conditional share options by the executive directors of the Company, for the year 2024, as approved by the Company’s OGSM from 25 June 2024

- “Su Fortuna Se Ha Construido A Base de La Defraudación Fiscal”: Críticas Resurgen Contra Ricardo Salinas en Medio de Nuevas Revelaciones Judiciales y Fiscaleso

- Digi Communications N.V. announces the availability of the instruction regarding the payment of share dividend for the 2024 financial year

- SOILRES project launches to revive Europe’s soils and future-proof farming

- Josh Case, ancien cadre d’ENGIE Amérique du Nord, PDG de Photosol US Renewable Energy et consultant d’EDF Amérique du Nord, engage aujourd’hui toute son énergie dans la lutte contre la dépendance

- Bizzy startet den AI Sales Agent in Deutschland: ein intelligenter Agent zur Automatisierung der Vertriebspipeline

- Bizzy lance son agent commercial en France : un assistant intelligent qui automatise la prospection

- Bizzy lancia l’AI Sales Agent in Italia: un agente intelligente che automatizza la pipeline di vendita

- Bizzy lanceert AI Sales Agent in Nederland: slimme assistent automatiseert de sales pipeline

- Bizzy startet AI Sales Agent in Österreich: ein smarter Agent, der die Sales-Pipeline automatisiert

- Bizzy wprowadza AI Sales Agent w Polsce: inteligentny agent, który automatyzuje budowę lejka sprzedaży

- Bizzy lanza su AI Sales Agent en España: un agente inteligente que automatiza la generación del pipeline de ventas

- Bizzy launches AI Sales Agent in the UK: a smart assistant that automates sales pipeline generation

- As Sober.Buzz Community Explodes Its Growth Globally it is Announcing “Spreading the Good BUZZ” Podcast Hosted by Josh Case Debuting July 7th

- Digi Communications N.V. announces the OGMS resolutions and the availability of the approved 2024 Annual Report

- Escándalo Judicial en Aumento Alarma a la Opinión Pública: Suprema Corte de México Enfrenta Acusaciones de Favoritismo hacia el Aspirante a Magnate Ricardo Salinas Pliego

- Winz.io Named AskGamblers’ Best Casino 2025

- Kissflow Doubles Down on Germany as a Strategic Growth Market with New AI Features and Enterprise Focus

- Digi Communications N.V. announces Share transaction made by a Non-Executive Director of the Company with class B shares

- Salinas Pliego Intenta Frenar Investigaciones Financieras: UIF y Expertos en Corrupción Prenden Alarmas

- Digital integrity at risk: EU Initiative to strengthen the Right to be forgotten gains momentum

- Orden Propuesta De Arresto E Incautación Contra Ricardo Salinas En Corte De EE.UU

- Digi Communications N.V. announced that Serghei Bulgac, CEO and Executive Director, sold 15,000 class B shares of the company’s stock

- PFMcrypto lancia un sistema di ottimizzazione del reddito basato sull’intelligenza artificiale: il mining di Bitcoin non è mai stato così facile

- Azteca Comunicaciones en Quiebra en Colombia: ¿Un Presagio para Banco Azteca?

- OptiSigns anuncia su expansión Europea

- OptiSigns annonce son expansion européenne

- OptiSigns kündigt europäische Expansion an

- OptiSigns Announces European Expansion

- Digi Communications NV announces release of Q1 2025 financial report

- Banco Azteca y Ricardo Salinas Pliego: Nuevas Revelaciones Aumentan la Preocupación por Riesgos Legales y Financieros

- Digi Communications NV announces Investors Call for the presentation of the Q1 2025 Financial Results

- Digi Communications N.V. announces the publication of the 2024 Annual Financial Report and convocation of the Company’s general shareholders meeting for June 18, 2025, for the approval of, among others, the 2024 Annual Financial Report, available on the Company’s website

- La Suprema Corte Sanciona a Ricardo Salinas de Grupo Elektra por Obstrucción Legal

- Digi Communications N.V. announces the conclusion of an Incremental to the Senior Facilities Agreement dated 21 April 2023

- 5P Europe Foundation: New Initiative for African Children

- 28-Mar-2025: Digi Communications N.V. announces the conclusion of Facilities Agreements by companies within Digi Group

- Aeroluxe Expeditions Enters U.S. Market with High-Touch Private Jet Journeys—At a More Accessible Price ↗️

- SABIO GROUP TAKES IT’S ‘DISRUPT’ CX PROGRAMME ACROSS EUROPE

- EU must invest in high-quality journalism and fact-checking tools to stop disinformation

- ¿Está Banco Azteca al borde de la quiebra o de una intervención gubernamental? Preocupaciones crecientes sobre la inestabilidad financiera

- Netmore and Zenze Partner to Deploy LoRaWAN® Networks for Cargo and Asset Monitoring at Ports and Terminals Worldwide

- Rise Point Capital: Co-investing with Independent Sponsors to Unlock International Investment Opportunities

- Netmore Launches Metering-as-a-Service to Accelerate Smart Metering for Water and Gas Utilities

- Digi Communications N.V. announces that a share transaction was made by a Non-Executive Director of the Company with class B shares

- La Ballata del Trasimeno: Il Mediometraggio si Trasforma in Mini Serie

- Digi Communications NV Announces Availability of 2024 Preliminary Financial Report

- Digi Communications N.V. announces the recent evolution and performance of the Company’s subsidiary in Spain

- BevZero Equipment Sales and Distribution Enhances Dealcoholization Capabilities with New ClearAlc 300 l/h Demonstration Unit in Spain Facility

- Digi Communications NV announces Investors Call for the presentation of the 2024 Preliminary Financial Results

- Reuters webinar: Omnibus regulation Reuters post-analysis

- Patients as Partners® Europe Launches the 9th Annual Event with 2025 Keynotes, Featured Speakers and Topics

- eVTOLUTION: Pioneering the Future of Urban Air Mobility

- Reuters webinar: Effective Sustainability Data Governance

- Las acusaciones de fraude contra Ricardo Salinas no son nuevas: una perspectiva histórica sobre los problemas legales del multimillonario

- Digi Communications N.V. Announces the release of the Financial Calendar for 2025

- USA Court Lambasts Ricardo Salinas Pliego For Contempt Of Court Order

- 3D Electronics: A New Frontier of Product Differentiation, Thinks IDTechEx

- Ringier Axel Springer Polska Faces Lawsuit for Over PLN 54 million

- Digi Communications N.V. announces the availability of the report on corporate income tax information for the financial year ending December 31, 2023

- Unlocking the Multi-Million-Dollar Opportunities in Quantum Computing

- Digi Communications N.V. Announces the Conclusion of Facilities Agreements by Companies within Digi Group

- The Hidden Gem of Deep Plane Facelifts

- KAZANU: Redefining Naturist Hospitality in Saint Martin ↗️

- New IDTechEx Report Predicts Regulatory Shifts Will Transform the Electric Light Commercial Vehicle Market

- Almost 1 in 4 Planes Sold in 2045 to be Battery Electric, Finds IDTechEx Sustainable Aviation Market Report

- Digi Communications N.V. announces the release of Q3 2024 financial results

- Digi Communications NV announces Investors Call for the presentation of the Q3 2024 Financial Results

- Pilot and Electriq Global announce collaboration to explore deployment of proprietary hydrogen transport, storage and power generation technology

- Digi Communications N.V. announces the conclusion of a Memorandum of Understanding by its subsidiary in Romania

- Digi Communications N.V. announces that the Company’s Portuguese subsidiary finalised the transaction with LORCA JVCO Limited

- Digi Communications N.V. announces that the Portuguese Competition Authority has granted clearance for the share purchase agreement concluded by the Company’s subsidiary in Portugal

- OMRON Healthcare introduceert nieuwe bloeddrukmeters met AI-aangedreven AFib-detectietechnologie; lancering in Europa september 2024

- OMRON Healthcare dévoile de nouveaux tensiomètres dotés d’une technologie de détection de la fibrillation auriculaire alimentée par l’IA, lancés en Europe en septembre 2024

- OMRON Healthcare presenta i nuovi misuratori della pressione sanguigna con tecnologia di rilevamento della fibrillazione atriale (AFib) basata sull’IA, in arrivo in Europa a settembre 2024

- OMRON Healthcare presenta los nuevos tensiómetros con tecnología de detección de fibrilación auricular (FA) e inteligencia artificial (IA), que se lanzarán en Europa en septiembre de 2024

- Alegerile din Moldova din 2024: O Bătălie pentru Democrație Împotriva Dezinformării

- Northcrest Developments launches design competition to reimagine 2-km former airport Runway into a vibrant pedestrianized corridor, shaping a new era of placemaking on an international scale

- The Road to Sustainable Electric Motors for EVs: IDTechEx Analyzes Key Factors

- Infrared Technology Breakthroughs Paving the Way for a US$500 Million Market, Says IDTechEx Report

- MegaFair Revolutionizes the iGaming Industry with Skill-Based Games

- European Commission Evaluates Poland’s Media Adherence to the Right to be Forgotten

- Global Race for Autonomous Trucks: Europe a Critical Region Transport Transformation

- Digi Communications N.V. confirms the full redemption of €450,000,000 Senior Secured Notes

- AT&T Obtiene Sentencia Contra Grupo Salinas Telecom, Propiedad de Ricardo Salinas, Sus Abogados se Retiran Mientras Él Mueve Activos Fuera de EE.UU. para Evitar Pagar la Sentencia

- Global Outlook for the Challenging Autonomous Bus and Roboshuttle Markets

- Evolving Brain-Computer Interface Market More Than Just Elon Musk’s Neuralink, Reports IDTechEx

- Latin Trails Wraps Up a Successful 3rd Quarter with Prestigious LATA Sustainability Award and Expands Conservation Initiatives ↗️

- Astor Asset Management 3 Ltd leitet Untersuchung für potenzielle Sammelklage gegen Ricardo Benjamín Salinas Pliego von Grupo ELEKTRA wegen Marktmanipulation und Wertpapierbetrug ein

- Digi Communications N.V. announces that the Company’s Romanian subsidiary exercised its right to redeem the Senior Secured Notes due in 2025 in principal amount of €450,000,000

- Astor Asset Management 3 Ltd Inicia Investigación de Demanda Colectiva Contra Ricardo Benjamín Salinas Pliego de Grupo ELEKTRA por Manipulación de Acciones y Fraude en Valores

- Astor Asset Management 3 Ltd Initiating Class Action Lawsuit Inquiry Against Ricardo Benjamín Salinas Pliego of Grupo ELEKTRA for Stock Manipulation & Securities Fraud

- Digi Communications N.V. announced that its Spanish subsidiary, Digi Spain Telecom S.L.U., has completed the first stage of selling a Fibre-to-the-Home (FTTH) network in 12 Spanish provinces

- Natural Cotton Color lancia la collezione "Calunga" a Milano

- Astor Asset Management 3 Ltd: Salinas Pliego Incumple Préstamo de $110 Millones USD y Viola Regulaciones Mexicanas

- Astor Asset Management 3 Ltd: Salinas Pliego Verstößt gegen Darlehensvertrag über 110 Mio. USD und Mexikanische Wertpapiergesetze

- ChargeEuropa zamyka rundę finansowania, której przewodził fundusz Shift4Good tym samym dokonując historycznej francuskiej inwestycji w polski sektor elektromobilności

- Strengthening EU Protections: Robert Szustkowski calls for safeguarding EU citizens’ rights to dignity

- Digi Communications NV announces the release of H1 2024 Financial Results

- Digi Communications N.V. announces that conditional stock options were granted to a director of the Company’s Romanian Subsidiary

- Digi Communications N.V. announces Investors Call for the presentation of the H1 2024 Financial Results

- Digi Communications N.V. announces the conclusion of a share purchase agreement by its subsidiary in Portugal

- Digi Communications N.V. Announces Rating Assigned by Fitch Ratings to Digi Communications N.V.

- Digi Communications N.V. announces significant agreements concluded by the Company’s subsidiaries in Spain

- SGW Global Appoints Telcomdis as the Official European Distributor for Motorola Nursery and Motorola Sound Products

- Digi Communications N.V. announces the availability of the instruction regarding the payment of share dividend for the 2023 financial year

- Digi Communications N.V. announces the exercise of conditional share options by the executive directors of the Company, for the year 2023, as approved by the Company’s Ordinary General Shareholders’ Meetings from 18th May 2021 and 28th December 2022

- Digi Communications N.V. announces the granting of conditional stock options to Executive Directors of the Company based on the general shareholders’ meeting approval from 25 June 2024

- Digi Communications N.V. announces the OGMS resolutions and the availability of the approved 2023 Annual Report

- Czech Composer Tatiana Mikova Presents Her String Quartet ‘In Modo Lidico’ at Carnegie Hall

- SWIFTT: A Copernicus-based forest management tool to map, mitigate, and prevent the main threats to EU forests

- WickedBet Unveils Exciting Euro 2024 Promotion with Boosted Odds

- Museum of Unrest: a new space for activism, art and design

- Digi Communications N.V. announces the conclusion of a Senior Facility Agreement by companies within Digi Group

- Digi Communications N.V. announces the agreements concluded by Digi Romania (formerly named RCS & RDS S.A.), the Romanian subsidiary of the Company

- Green Light for Henri Hotel, Restaurants and Shops in the “Alter Fischereihafen” (Old Fishing Port) in Cuxhaven, opening Summer 2026

- Digi Communications N.V. reports consolidated revenues and other income of EUR 447 million, adjusted EBITDA (excluding IFRS 16) of EUR 140 million for Q1 2024

- Digi Communications announces the conclusion of Facilities Agreements by companies from Digi Group

- Digi Communications N.V. Announces the convocation of the Company’s general shareholders meeting for 25 June 2024 for the approval of, among others, the 2023 Annual Report

- Digi Communications NV announces Investors Call for the presentation of the Q1 2024 Financial Results

- Digi Communications intends to propose to shareholders the distribution of dividends for the fiscal year 2023 at the upcoming General Meeting of Shareholders, which shall take place in June 2024

- Digi Communications N.V. announces the availability of the Romanian version of the 2023 Annual Report

- Digi Communications N.V. announces the availability of the 2023 Annual Report

- International Airlines Group adopts Airline Economics by Skailark ↗️

- BevZero Spain Enhances Sustainability Efforts with Installation of Solar Panels at Production Facility

- Digi Communications N.V. announces share transaction made by an Executive Director of the Company with class B shares

- BevZero South Africa Achieves FSSC 22000 Food Safety Certification

- Digi Communications N.V.: Digi Spain Enters Agreement to Sell FTTH Network to International Investors for Up to EUR 750 Million

- Patients as Partners® Europe Announces the Launch of 8th Annual Meeting with 2024 Keynotes and Topics

- driveMybox continues its international expansion: Hungary as a new strategic location

- Monesave introduces Socialised budgeting: Meet the app quietly revolutionising how users budget

- Digi Communications NV announces the release of the 2023 Preliminary Financial Results

- Digi Communications NV announces Investors Call for the presentation of the 2023 Preliminary Financial Results

- Lensa, един от най-ценените търговци на оптика в Румъния, пристига в България. Първият шоурум е открит в София

- Criando o futuro: desenvolvimento da AENO no mercado de consumo em Portugal

- Digi Communications N.V. Announces the release of the Financial Calendar for 2024

- Customer Data Platform Industry Attracts New Participants: CDP Institute Report

- eCarsTrade annonce Dirk Van Roost au poste de Directeur Administratif et Financier: une décision stratégique pour la croissance à venir

- BevZero Announces Strategic Partnership with TOMSA Desil to Distribute equipment for sustainability in the wine industry, as well as the development of Next-Gen Dealcoholization technology

- Editor's pick archive....