12-9-2013 — /EuropaWire/ — The Commission today adopted major regulatory proposals to complete the telecoms single market and deliver a Connected Continent. The overarching aim is to build a connected, competitive continent and enabling sustainable digital jobs and industries; making life better by ensuring consumers can enjoy the digital devices and services they love; and making it easier for European businesses & entrepreneurs to create the jobs of the future

A Connected continent is about: Faster connections. Easier business. Simpler life. Ready for the future Yes to single market; yes to net neutrality; no to roaming premiums; no to red tape

1. Overview

Why is this important for growth?

Europe desperately needs to tap into new sources of growth and innovation. . Since each economic sector today increasingly depends on good connectivity to be competitive, the solution lies in harnessing digital technology and ICT (source of half our productivity growth), to the single market (our crown jewel). We can’t afford to remain trapped in 28 national markets; if this continues, we will fail to feed the digital economy the raw materials it needs: connectivity and scale.

When enabled, the digital ecosystem grows fast (faster than China’s economy) and creates jobs (794,000 in app economy in just five years, while economy was in recession); it stimulates innovation and business activity across the economy, through heightened productivity, efficiency and revenue. The missing cornerstone in this digital ecosystem is a Telecoms Single Market, which would permanently increase GDP (basis: 2010) by nearly 1% every year if delivered.

What about jobs and consumer?

Europeans are struggling with the effects of economic crisis. It is essential to take every enabling action possible to create jobs – and no sector offers better opportunities for employment growth (especially for young people) than the digital sector. It is also essential that citizens have full access to the internet, which they value highly, and that they are protected from unfair charges and practices such as roaming rip-offs and opaque contracts.

What about the EU’s industrial and global leadership?

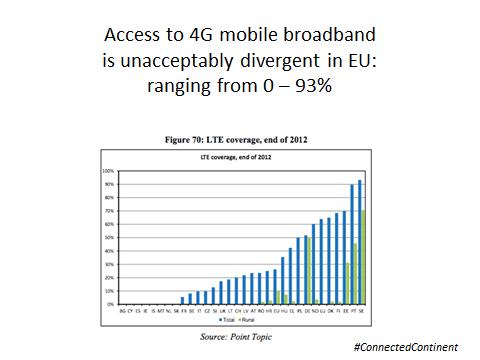

The world envied Europe as we pioneered the global mobile industry in the early 1990s (GSM), but our industry often has no home market to sell to (for example, 4G) consumers miss out on latest improvements or their devices lack the networks needed to be enjoyed fully. These problems hurt all sectors and rob Europe of jobs it badly needs EU companies are not global internet players. Lagos has 4G mobile, but Brussels does not.

Europe still retains global ICT industries in areas like electronics, robotics, and telecommunications equipment. It has innovated in healthcare applications, smart city technologies, electronic public services and open data. But a fragmented market is not fit for global competition. Only a telecoms single market will allow the whole digital ecosystem to be more dynamic and recapture a leading global role.

What has the Commission proposed?

The Commission has proposed legislative changes to complementing the current regulatory framework that would make a reality of two key EU Treaty Principles: the freedom to provide and to consumer (digital) services wherever one is in the EU.

The proposal does this by pushing the telecoms sector fully into the internet age (incentives for new business models and more investment) and removing bottlenecks and barriers so Europe’s 28 national telecoms markets become a single market (building on 2009 Telecoms Framework Directive, and more than 26 years of work to create that single market) The proposal is a package, not a pick -and choose menu, to ensure all stakeholder groups are net beneficiaries.

What is in the proposal?

- Simplification and reduction of regulation for companies

- More coordination of spectrum allocation – so that we see more wireless broadband, more 4G, and the emergence of pan-EU mobile companies with integrated networks

- Standardised wholesale products: encourages more competition between more companies

- Protection of Open internet: guarantees for net neutrality, innovation and consumer rights.

- Pushing roaming premiums out of the market: a carrot and stick approach to say goodbye to roaming premiums by 2016 or earlier.

- Consumer protection: plain language contracts, with more comparable information, and greater rights to switch provider or contract.

What is not in the proposal?

- No single telecoms regulator

- No Eurotariff termination rates

- No change to definition of electronic communications services provider

- No pan-European spectrum license

- No ban on differentiated internet products

Why does this matter?

Telecoms networks are the foundation of the wider digital economy. Every sector now depends on connectivity. This means today’s telecoms sector is holding back the rest of the economy.

Networks are too slow, unreliable and insecure for most Europeans; Telecoms companies often have huge debts, making it hard to invest in improvements. We need to turn the sector around so that it enables more productivity, jobs and growth.

As a starting point, the sector needs a single market (an annual 0.9% boost to GDP).This is the biggest single EU-wide macro-economic boost available in the next few years.

More than 4 out of 10 companies are dissatisfied with the connectivity they are getting. They find services poor and speeds too low. This is a drag on their competitiveness. Consumers are also sick of unfair charges, confusing information, and non-functioning devices. Delivering this package is a matter of political credibility for EU.

Waiting will hurt everyone, with no guarantee that “big bang” approach could be politically negotiated. We have to act now to ensure other economies do not race ahead, in ability to access online content and applications of their choice, and prevent our telecoms companies from creating wider damage through further decline or even bankruptcy.

How have we got here?

The 2013 Spring European Council conclusions called for the Commission to present “concrete measures to achieve the single market in ICT as early as possible” in time for the October European Council. Three years of consultations, public events and private meetings inform these proposals – including two major public events with 1000 participants in June.

2. The main elements of the proposal

| Problem | Solution | |

| Operators wanting to go cross-border face red tape (both hurdles and burdens) |

|

|

| Inconsistent obligations for operators operating in more than one MS |

|

|

| Inconsistent fixed wholesale access for service providers operating in more than one MS |

|

|

| Uncoordinated spectrum access conditions for mobile operators make it more difficult to plan long-term investments, operate cross-border and eventually gain scale. Today vital wireless broadband spectrum is released at different moments in the EU, subject to different timing considerations and under different conditions |

|

|

| Congested networks because soaring data demand is outstripping the capacity of existing networks. The need to increase data capacity |

|

|

| No EU-wide consumer rules (hurts and confuses both consumer and operator) |

|

|

| Users blocked from using full internet, and face different rules in each member state |

|

|

| Roaming is an anomaly in a Single Market |

|

|

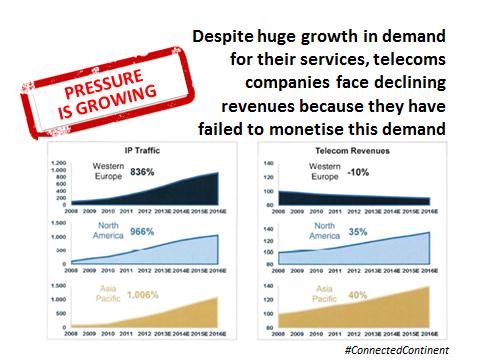

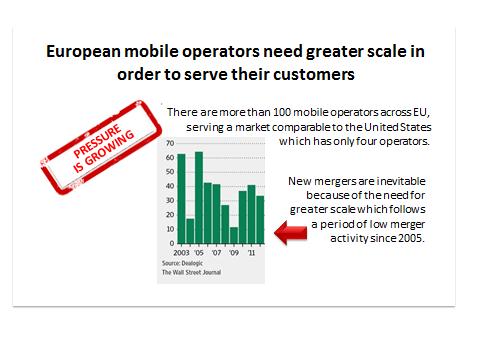

3. EU telecoms sector is in difficulty

There has been massive growth in demand (especially data), however, since last reform of EU telecoms rules, (IP/11/622) this growth has not been monetized. Revenue is declining in real terms (-2.2% in 2011 and -1.1% in 2012) and relative to US & Asian & other markets. Market capitalization is down 22% since 2011. Moreover, Europe’s former telecoms monopolies have a net investment rate of virtually zero, lagging behind competitors (source: HSBC). Wireless investment is half the rate of US/Canada since 2002.

Several operators struggle with high debt, as much as three times as high as company stock-market value (Telecom Italia) and upwards of €30bn (Telefonica) Telecoms underperformance is holding back the rest of the economy. In particular, it harms sectors such as equipment manufacturers, internet entrepreneurs,cars, smart objects, wholesale, retail and logistics, health care and creative industries.

What caused this?

- The telecoms sector has been slow to reform (e.g. responding to Skype, data revolution, ditching cash cows like roaming)

- Cultural and regulatory differences mean Europe is not seen as place to start or / grow a global internet business (compared to Silicon Valley

- Fragmentation of European market and regulation along national lines prevents efficiencies and scale

- The short term interest of national government maximising revenue from spectrum auctions sapped large sums from many telecoms companies, eating away at investments in network built-out.

- Companies cannot procure crucial “raw materials” such as internet connectivity or access to harmonised frequencies under coherent and competitive conditions from a single provider in several Member States (because we lack single market for these “materials”).

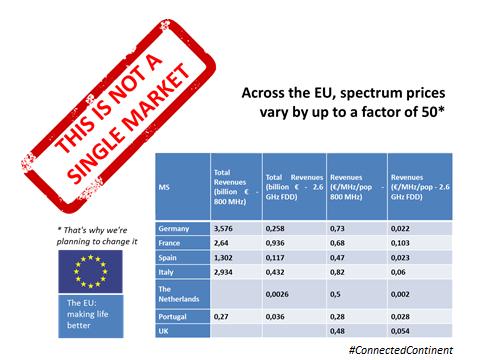

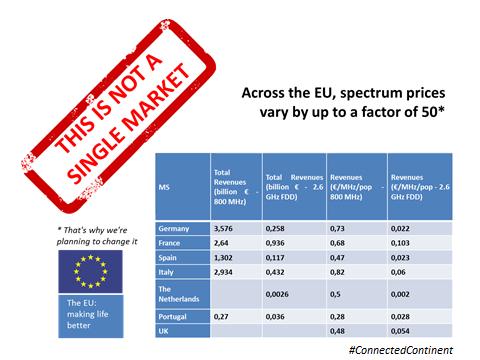

DIVERGENCE IN EUROPE’S MARKETS

- Operating license fees range from €0 to €3000

- Some countries even specify which font needs to be used in consumer contracts

- Administration fees for holding a license range from €5,000 to €15,000 Between EU countries there is 774% revenue differential per call minute.

- The price of spectrum rights varies by up to a factor of 50 (2600Ghz band)

- Wholesale copper access prices which network owners may charge to competitors leasing the network range from 4 to14 euros per month (333% difference)

- There is a different approach to regulation of wholesale broadband markets in virtually every member state

- International mobile calls vary from €0.35 to €1.19 per minute across the EU.

In five years this will mean that ….

| WHO | WHAT |

| TELECOMS OPERATORS |

|

| EQUIPMENT MAKERS |

|

| START-UP |

|

| CITIZENS / ORDINARY INTERNET USERS |

|

| BUSINESSES IN A DIGITAL ECONOMY |

|

| OVERALL ECONOMY |

|

4. Delivering sustainable jobs

A Connected Continent will provide a foundation for sustainable jobs with good pay

PROBLEMS Unemployment levels are unacceptably high. Europe is in a digital transition. There are millions of new digital job opportunities – literally a million vacancies in 2015 predicted because of skills gap – and also a series of necessary reforms that are not yet complete.

Today companies relying on the digital economy find it difficult to expand and invest, they find it difficult to employ more people. Because of underinvestment in networks, associated industries (from apps to telecoms equipment makers) don’t achieve full potential and do not create the demand for better networks. We need to break this vicious circle.

SOLUTIONS OFFERED

- Make the digital sector, which has a very young workforce, a jobs priority as a way to address youth unemployment in Europe.

- Help start-ups grow by giving them the world’s biggest market to sell to from Day 1. (for example, after a policy battle, French tech-start-ups achieved 24% employment growth in 2012).

- Support labour force changes in telecoms companies which have not adapted to new digital, data-driven business models

- Work with companies in a Grand Coalition for Digital Skills and Jobs, to train individuals and to improve the overall digital ecosystem.

IMPACTS AND EXAMPLES

- 794,000 jobs created by app economy, including nearly 600,000 in the app economy directly in last five years. This is what happens when a borderless environment exists.

- Those industries need good networks. According to Analysis Mason and Tech4i2 (2013) even “modest” intervention to build fast broadband infrastructure, 447,000 new jobs are expected to be created in the first 3 years and two million new jobs by

- For telecoms: A real telecoms single market will support growth and counter the trend of 10% drop in direct telecoms labour force expected in next few years.

- For other businesses: Cloud computing can only work at EU-scale or greater, and demand for it will drive further investments in better networks. The cloud is the “killer app” for superfast broadband. Standardised inputs, bigger markets, reduced market distortions (like blocked services), and greater digital skills combine to it easier for businesses like cloud providers to generate new jobs.

Vice President Neelie Kroes said “We add to unemployment, especially youth unemployment, every day we don’t deliver a telecoms single market ”

5. Less red tape for companies

#1 Single authorisation

PROBLEM: There is no pan-EU mobile or fixed telecoms company In theory it is possible to operate in all Member States and yet no-one does, because the system does not work You must comply with different registration requirements in each Member State where services are provided. Operators face extra costs and lose time dealing with different and inconsistent nationally enforced rules, with varying market outcomes.

SOLUTIONS OFFERED

- Learn and copy from other sectors in EU single market,(such as banking) by offering operators the chance to operate in all countries through a single EU authorisation, and the chance to deal with that one authority on other licensing issues.

- Pan-EU legal certainty & the right to equal regulatory treatment

IMPACTS

- More companies operating with ease across borders.

- For business: Lower entry barriers for new companies, lower costs for service. provision and new opportunities to expand into additional EU member states.

- For consumers: Benefit from new offers from new competitors in their MS.

- For the future: real basis for a wider digital single market in Europe.

Vice President Neelie Kroes said “The right to operate everywhere is not real unless you can enforce it. The best way to do that is a single authorisation, because it is a guarantee. This is for tomorrow’s companies as well as existing companies.”

#2 New Criteria for Regulating Markets

PROBLEMS: National regulators are over-regulating or under-regulating specific telecoms (sub) markets, which they define differently.

SOLUTIONS OFFERED

Strengthening, by inclusion in the Regulation, of the well-established “3 criteria” test that the Commission applies to select markets that should be regulated in its “Recommendation on Relevant Markets”, and that national regulators must apply if they wish to regulate markets that are not in that Recommendation . This will now be legally enforceable.

- In order to regulate three criteria would need to be met:

- National regulators would also have to consider all competitive constraints [including from Over The Top players (OTTs)].

IMPACTS

- For business: lighter regulation consistent with most other markets.

- For consumers: more consistent protection in instances where incumbent companies have a dominant position.

- For the future: normalisation of telecoms market (i.e. the telecoms market to become like others , where companies compete and consumers have choice)

Vice President Neelie Kroes said “We want to cut red tape as part of normalising the telecoms sector. Operators should not be subject to national whim or inconsistency.”

#3 Article 7 veto on remedies

PROBLEMS: National Telecoms regulators apply EU regulation inconsistently, or regulate unnecessarily, creating uncertainty for telcos.

SOLUTIONS OFFERED

- Ensure consistency through possible use of Commission veto powers on national decisions on remedies

IMPACTS

- For business: The Commission veto power will stop over-regulation.

- For consumers: More consistency helps European providers, giving them the confidence to bring forward a wider range of exciting, new consumer offers.

- For the future: key to achieving normalisation of telecoms market

Vice President Neelie Kroes said “The aim is to gradually make the telecoms sector a “normal” economic sector with limited ‘ex ante’ rules and responsibility shifting to ex-post regulation.

6. Easier wholesale products

Connected Continent means, wholesale products for fixed networks (spectrum is

the key input for mobile)

PROBLEMS: The business-to-business market (around half of whole EU telecoms market) suffers from a lack of consistent design of products and connectivity, meaning that potential demand is not tapped.

New entrants to consumer broadband markets are hampered by the wide variation in regulated network access products, making common business models and technical choices impossible for multiple Member States.

SOLUTIONS OFFERED

- In cases where dominant operators with significant market power are obliged to offer competitors virtual access to their networks, both buyer and seller should face harmonised conditions and features across EU.

- Common criteria for assured service quality connectivity negotiated between operators on commercial terms.

IMPACTS

- For telecoms businesses: Easier to expand into additional European markets.

- For other businesses: key for non-telco companies such as eHealth providers, cloud computing service providers, videoconference companies – it means they can be sure to meet contract and service level commitments.

Vice President Neelie Kroes said “European standardised virtual access products, with assured Quality of Service, will help expand the business-to-business market. The new obligations will replace rather than add to national obligations”

7. Spectrum and 4G

Connected Continent means spectrum for wireless broadband

PROBLEMS

- Europe faces spectrum spaghetti – a tangled mess of rules and prices and timetables – that makes pan-European mobile business strategies impossible to implement.

- The majority of spectrum allocation is fragmented and countries are not following their obligations to assign spectrum.

- Only 5 of 28 Member States have assigned all 100% of the 1025 MHz of EU-harmonised spectrum for mobile broadband due to be assigned by end 2012.

- Only 12 Member States have released the 800 MHz band to operators, the band most critical for 4G LTE and expanding broadband coverage into rural areas.

SOLUTIONS OFFERED

- Harmonise the timing of spectrum release and harmonise duration of rights

- Introduce possibility to use a comitology veto (COCOM not Commission alone) to deal with problems such as overpriced spectrum auctions

- Apply a set of principles and criteria aimed at ensuring development of an EU wireless space.

- Appropriate compensations for timely freeing up of spectrum, infrastructure and spectrum sharing, as well as spectrum trading – for example so unused spectrum is put to good use.

IMPACTS

- For businesses: good for all mobile operators, especially those wanting to expand.

- For consumers: faster roll-out of wireless broadband especially in rural areas.

- For the future: your mobile will be free of dropped calls and pages that don’t load. Efficient use and coordinated access to spectrum will lead to more network investment. Short-termist high fees policies that are not consistent with good spectrum management will be constrained, favouring capital investment in networks.

Vice President Neelie Kroes said “We need a new approach to spectrum so that Europeans can enjoy the latest mobile developments. This is a sensitive issue for national governments, so we are treading carefully but purposefully. It’s just a fact that demand for data is soaring and the current spectrum system cannot cope. Networks face congestion or breakdown under the status quo – disrupting citizens and business – and mobile companies have no chance to build a pan-EU company.”

Connected Continent means spectrum for wireless broadband

PROBLEMS

- Europe is not a developing continent, but you would never know it from our level of 4G coverage. 4G/LTE reaches only 26% of the European population. In the US one company alone (Verizon) reaches 90%!

- In 2012 Europe – world’s biggest economy – had 6% of the world LTE connections, compared to USA 47%, South Korea 27%, Japan 13%,

- Congestion still likely on 4G, even if the target of 1200 MHz of harmonised spectrum for mobile broadband in Europe is achieved. We need other back-up systems for off-loading demand.

SOLUTIONS OFFERED

- Increase capacity through less onerous authorisation conditions

- Increase capacity through removal of unnecessary deployment restriction overly complex procedures for granting permits for micro base stations, or wireless hotspot deployment.

- Increase capacity through right to share access to WI-FI access points.

- Operational improvements such as the common use of active and passive infrastructures, spectrum sharing and spectrum trading will make it easier and cheaper to deploy and/or renovate wireless networks with new technologies.

- Common regulatory principles for spectrum authorisations, common criteria for the availability and conditions of spectrum.

IMPACTS

- Mobile network operators will be able to use small area access point technologies (4G or Wi-Fi) to increase the capacity of the networks.

- Fixed line network operators will be able provide complementary wireless broadband connectivity services through public access to Wi-Fi networks, that may – depending on consent – be located in the consumer’s or business’ premises.

- End-users will have more choice for wireless broadband connectivity easier possibility to offer Wi-Fi based access to the internet to others.

Vice President Neelie Kroes said “Operators need to expand the capacity of their wireless broadband networks in cost-efficient ways. Consumers and businesses want to wirelessly use their fixed lines: Wi-Fi or 4G small cells will do the trick. We are not forcing end-users to share their Wi-Fi, but giving them choice .”

8. Stable copper network access prices

A Connected Continent means .stabilising copper network access prices

PROBLEMS

- Copper network owners need stability of income from renting out their networks to competitors, to enable investment in faster “next generation” networks.

- Alternative operators do not have a sufficiently consistent basis for planning pan-EU business operation, based on stable and consistent access prices.

- National regulators apply up to six different ways of calculating wholesale copper access prices (for example by choosing to apply different asset lifetimes and the depreciation methods).

- This means the price of copper access ranges from 4 to 14 euros per month for the copper LLU (local loop unbundling) monthly wholesale rental.

SOLUTIONS OFFERED

- Long-term price stability and more aligned prices across the single market.

- No imposition of price regulation on access to high-speed next generation networks where demonstrable constraints against anti-competitive behaviour exist in the retail markets, and strengthened non-discrimination obligations to ensure that competition is strong.

IMPACTS

- For telecoms businesses: today’s network owners will have greater certainty over their income allowing them to plan further network upgrades. Today’s alternative operators will share the risk of network upgrades where price regulation is not imposed. No artificial subsidy to copper network access to undercut next generation network deployment.

- For other businesses: short-term = negligible, long-term = faster networks

- For consumers: fair pricing and improved quality and range of services as a result of improved wholesale conditions at the wholesale level.

- For the future: Europe will enjoy better networks

Vice President Neelie Kroes said “We aim to stabilise prices over a six year period to give the industry certainty. This allows further network investment and more rational business decisions. In order to stabilise prices over the medium-term it is obvious that there must be some initial price adjustments order to improve convergence of costing approaches.”

9. An end to Roaming and intra-EU call premiums

A Connected Continent means an end to premiums for roaming and intra EU calls

PROBLEMS

- High premiums for roaming and intra-EU calls are an excessive irritant to business and leisure customers; they are a market distortion with no rational place in a single market – they teach users to fear their phones instead of using them.

SOLUTIONS OFFERED

- Create a true European communications space by fading out and eliminating the difference in charges paid for domestic, roaming and intra-EU calls.

ROAMING:

- Operators will lose the right to charge for incoming calls while a user is travelling abroad in EU, and additionally face a choice between a carrot and a stick.

- The carrot is that they can be largely free of European regulation, if they extend their domestic plans/bundles so that by July 2016, customers throughout the Union are able to use their phones and smartphones while travelling throughout the Union at domestic rates. There will be a glidepath from July 2014, allowing operators to adapt either the number of plans they offer or the number of countries they cover at domestic rates.

- The stick is being subject the 2012 roaming regulation which forces companies to offer their customers the possibility to roam with new competitors (alternative roaming providers). A customer will have the right to leave their domestic operator when travelling and take cheaper roaming services from a local company or a rival company in the home country, without changing their SIM card.

EUROPEAN FIXED CALLS:

- Operators will have to charge no more than a domestic long-distance call for all fixed line calls to other EU member states. Any extra costs have to be objectively justified.

EUROPEAN MOBILE COMMUNICATION:

- Operators will have to charge no more than the euro-tariffs for regulated voice and SMS roaming communications for mobile communications to other EU member states. Any extra costs have to be objectively justified.

IMPACTS

- Consumers: No fear, more convenience, reasonable prices.

This benefits those that travel and those who never leave home; those who love their mobiles and those who only have landlines. Consumers and businesses alike. - For telecoms businesses: A direct impact of around 0,5% revenue decrease due to elimination of price differentiation between national and intra-EU calls, compensated by higher consumption volume in the medium term. The proposed roaming regime is optional and is expected to be beneficial to operators in the medium term.

- For other businesses: further savings in addition to the €1100 a year already saved by a moderate business traveller in the course of year (compared to 2009 prices), The abolition of roaming charges will promote the cross-border use of connected devices and services (e.g. M2M solutions), and boost the evolution of mobile data applications, thereby contributing to a more favourable business environment

- For the future: proof that real reform is possible in telecoms, and that the EU can make direct tangible improvements to citizens lives.

Vice President Neelie Kroes said: “Our proposal on roaming builds on the existing rules by offering operators the incentive to gradually introduce retail offers in which domestic service rate applies both to domestic services and roaming services. (Roam-like-at-Home). It also puts an end to unjustified price distinctions between the price of national and “international” (intra-EU) calls.”

EU consumers should not pay more for calling abroad or when they travel abroad.

The current roaming rules are designed to reduce the problems of national markets but they don’t build a real single market. The current rules were written before the economic urgency of establishing the telecoms single market was apparent.

The current rules provide a safety net and a stick to complement the new opportunities and ‘carrot’ contained in this package.

Domestic mobile prices have consistently fallen alongside the previous three reductions in mobile roaming price caps. There is no evidence to suggest that eliminating roaming premiums will push these prices up.”

10. Consolidation in the telecoms sector

A Connected Continent means consolidation in telecoms sector

PROBLEMS

- There are hundreds of telecom operators in Europe, but none active in all Member States.

- Several major companies (e.g. Vodafone, France Telecom) have begun to withdraw from certain Member States’ markets. Where they expand it is often outside the European Union.

- An average European can only choose among 3 or 4 alternative providers.

- Telecom operators need bigger scale to become more competitive global players and increase their ability to invest and expand at a time when consumers increasingly value faster networks and EU-wide convenience.

SOLUTIONS OFFERED

- There is no reason to change competition rules. Those rules pose few problems for cross-border mergers.

- In addition, by creating the conditions for a real single market (such as a single space for calls and data, and harmonised consumer rights, and the possibility to make pan-EU investments), we create the conditions for a different way to look at markets from a competition perspective.

IMPACTS

- For telecoms businesses: greater opportunities to consolidate and become pan-European businesses with the necessary scale to compete globally

- For other businesses: greater access to pan-European services offered by pan-European operators

- For consumers: benefit from a larger choice of alternative operators, better networks and other services than pan-European businesses can provide

- For the future: a market structure and market offers that compare favourably with our global competitors

Vice President Neelie Kroes said: “Creating a single market is our policy objective. Consolidation, on its own, cannot be a policy objective. Why? First, mergers are never an end in themselves. Second, we cannot put the cart before the horse.

“Creating a Single Telecoms Market would allow operators to expand more easily to other European markets and change way in which consolidation is looked at under applicable EU competition control rules. But creating a single market is the pre-condition for changes in the competition law analysis.”

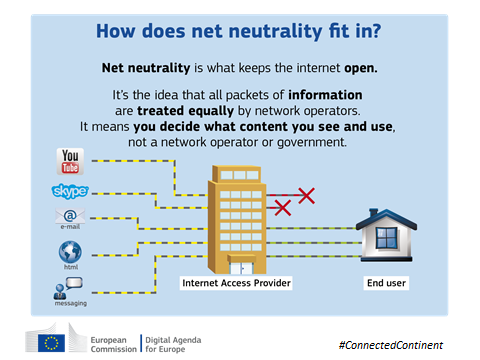

11. Yes to Net Neutrality!

A Connected Continent means an open internet

PROBLEMS

- There are no clear rules on net neutrality today at EU level, leaving 96% of Europeans without legal protection for their right to access the full open internet.

- National regulators do not have the power to intervene against blocking and throttling under current EU rules.

- Some EU Member States (NL, SI) have adopted laws, other countries are reflecting on measures, but without EU action this could further fragment the European market, and significantly complicate the integrated management of multi-territorial networks.

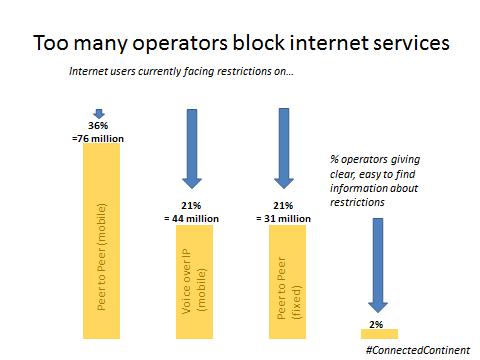

- The blocking and throttling of P2P and VoIP is the most common example of unacceptable traffic management by operators: around 21% of fixed Internet access subscribers and around 36% of mobile subscriptions are affected by restrictions.

- This causes problems for: consumers who can’t enjoy full internet; content and application providers who do not have a guaranteed access to consumers, and are prevented from innovating in the long term; operators who face different approaches regarding traffic management practices in different Member States and who are not encouraged to create new business models, but simply protect past/current territory and traditional revenue sources like voice calls.

SOLUTIONS OFFERED

- This proposal will end discriminatory blocking and throttling and deliver effective protection of the open internet. It sets out clear rules for traffic management on the Internet, which has to be non-discriminatory, proportionate and transparent.

- Companies would however be allowed to differentiate their offers (for example by speed) and compete on enhanced quality of service. There is nothing unusual about this – postal services (express mail) and airlines (economy/business class) have done this for decades. But this is subject to a vital pre-condition: that the quality of open Internet must not be impaired.

- To meet end-users’ demand for better service quality, content providers may agree deals with internet providers to assure a certain quality of service (“specialised services”). Such offers will enable telecom operators to generate additional revenue streams from OTT actors, content providers as well as from consumers, who are willing to pay for better or faster services. These revenues, in turn, will enable operators to finance investments into network upgrades and expansion.

- Specialised services must not lead to quality degradation of the “normal” Internet. National regulators will monitor quality of service and may impose minimum quality requirements, under Commission coordination.

IMPACTS

- For business: Stepping stone for innovators, who will not see their applications and services blocked and who will be able to choose to pay for a guaranteed quality of service (ex: videoconference businesses, cloud computing, e-health).

- European operators can develop new business models on a pan-European scale.

- For consumers: Will be given new rights that they do not have today. Will be able to access all contents and applications of their choice on any device they choose (within the limits of any contracted data volumes or speeds and subject to existing laws) They will also benefit from a greater range of high-quality services on offer. They will have access to an open internet, vital for freedom of expression and debates, as well as the entry point for innovative online start-ups.

- For the future: A real basis for providing and enjoying services everywhere in the EU. It will allow innovative companies to launch services without fear of blocking or throttling and design new services requiring a guaranteed quality of service. Operators will have access to additional revenue streams to finance investments into network upgrades and expansion.

Vice President Neelie Kroes said: “We do not have protection of net neutrality in Europe today. This proposal will ensure it. The proposal will optimise the outcome for end-users, content providers and Internet service providers.

12. New consumer rights

A Connected Continent means new rights for consumers: #1 Quality of Service

PROBLEMS

- Today operators are often not sufficiently transparent on their traffic management practices as well as on the quality of service actually provided.

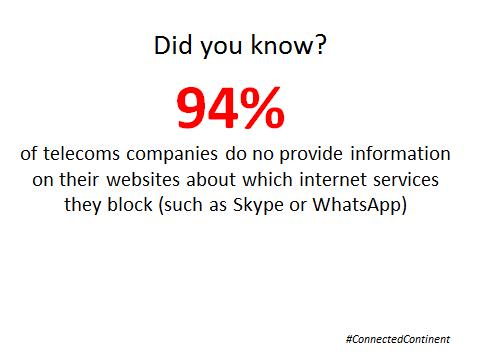

- 94% of consumers think that ISPs do not provide clear information on their website on blocking/throttling of specific applications or services.

- There are major discrepancies between advertised speeds and actual speeds on fixed networks. On average, EU consumers receive only 74% of the advertised headline speed they have paid for.

SOLUTIONS OFFERED

- Operators required to supply (both public and contractual) information on the average speeds they actually provide to their customers during normal and peak times, data volume limitations, and on traffic management practices.

- National regulators required to monitor quality of service and may impose minimum quality requirements, under Commission control.

- Consumers can terminate their contract or claim damages if there is a significant and non-temporary discrepancy between what they were promised and the service they actually get (e.g.: speed).

IMPACTS

- For business: Increased chances for price and quality competition as consumers are more aware of services received and can more easily change providers if they are unsatisfied or seek a different type of service.

- For consumers: Will be protected against misleading offers and will have a real understanding of the service they are entitled to expect and the right to leave if they are not happy with it.

- For the future: Better informed consumers can properly choose the service provider and offers that suit them best and obtain the services they paid for.

Vice President Neelie Kroes said: “These measures will achieve real transparency and enable consumers to give informed consent. You need to know what you are getting, and not getting, before you sign and pay. These EU-wide requirements are necessary to make European single consumer space work.”

A Connected Continent means new rights for consumers: #2 better contracts and more transparency

PROBLEMS

Today contracts are hard to understand, do not include critical information for the consumer, and are difficult to enforce or leave. Consumers are frequently locked in to internet and phone contracts. Barriers to switching include length of switching time, loss of the email address, high termination fees and long notice periods.

Almost half (44%) of the respondents experienced problems of some kinds when switching (study “The Functioning of the Market for Internet Access and Provision from a Consumer Perspective”).

SOLUTIONS OFFERED

- Extra information to be included in contracts including:

- data volume limitations,

- the actual data speeds,

- how to monitor consumption and

- an explanation of the practical impact of the service characteristics on the use of content, applications and services;

- Contract periods: There can be no initial commitment exceeding 24 months, and a 12 month-only option must be provided

- Contract roll-over: warning provided at least one month in advance, with an option to oppose tacit extension of the contract; in case where a contract rolls over the contract can be terminated without any costs with a 1 month notice.

- Contract termination: consumer to gain right to terminate any contract after 6 months without penalty with a one-month notice period; reimbursement due only for residual value of subsidised equipment/promotions, if any. Any restriction on the use of the terminal equipment on other networks must be lifted free of charge once any due compensation of subsidies and/or promotion is paid.

Switching:

- Explicit right to port within the shortest possible time. Direct charges to end-users, if any, should not act as a disincentive to change provider;

- Explicit prohibition of switching users to another provider against their will;

- Automatic cancellation of old contracts with losing providers after the switch without end-users having to contact their losing provider;

- Right of pre-paid subscribers to obtain a refund of any remaining credit when switching;

- Provision of email forwarding for customers from old ISP to new one (where this ISP previously provided an email address);

- Non-allocation of the initial email address to another end-user at least before a period of two years.

TRANSPARENCY:

- Provision of information on volumes, tariffs and quality of service provided, actual performance of service;

- Mandatory availability of comparison tools provided by national regulator or accredited third parties to allow users to know the actual performance of electronic communication network access and services and the cost of alternative usage patterns;

- End-user compensation for abuse or delays of switching:

- Extension of transparency safeguards of the roaming regulation (alert mechanism, cut-off limit) to domestic communications

- bill-shock mechanism to avoid “bad surprises”.

IMPACTS

- For business: Increased chances for competition as consumers are more aware of services received and can change operators more easily. This leads to new opportunities for provides with attractive offers which meet consumer demands..

- For consumers: Can hold service providers to account over service parameters offered; and can better enforce their rights if they are not respected. It becomes easier to change their provider. They can control their consumption and are protected against bill shocks.

- For the future: Better informed consumers that can more easily enforce their rights. Satisfied consumers are more likely to increase their consumption. Netter service quality thanks to more switching and competition

Vice President Neelie Kroes said: “These measures will empower consumers to claim what they pay for. It will help you leave your provider you are aren’t getting what you pay for, or simply want a different type of service. You would have the same rights no matter where you are in Europe and who your provider is.”

“The new provisions on transparency and switching will substantially reinforce consumer rights and encourage competition between providers. These EU-wide requirements are necessary to make European single consumer place work.”

13. Rules fit for a telecoms single market

PROBLEMS

The current EU rules are not sufficient to deliver a telecoms single market.

SOLUTIONS OFFERED

- Keep institutional changes to the minimum necessary to enable the single market including a full-time chair with a 3 year mandate to provide greater consistency and direction to work of BEREC (Body of European Regulators of Electronic Communcations).

- This means greater co-ordination between national regulatory authorities with a key focus on identifying and then applying best practices, additional EU supervision of national regulatory decisions affecting companies that benefits from a single authorisation in the EU.

IMPACTS

- For regulators: minimal changes to BEREC functions, more coordination between national regulators and Commission.

- For businesses: simpler dealings with government

- For consumers: easier to know who is in charge when you have a complaint

- For the future: enables a full telecoms and digital single market

Vice President Neelie Kroes said “The proposal focuses on users rather than structures. The proposal affects co-ordination, but not the balance of competences between the European Commission and the Member State. There would therefore no shift of powers from Member States to Brussels. We are not, building new institutions. We are not abolishing bodies like BEREC.”

- Digi Communications N.V. announces share transaction made by an Executive Director of the Company with class B shares

- BevZero South Africa Achieves FSSC 22000 Food Safety Certification

- Digi Communications N.V.: Digi Spain Enters Agreement to Sell FTTH Network to International Investors for Up to EUR 750 Million

- Patients as Partners® Europe Announces the Launch of 8th Annual Meeting with 2024 Keynotes and Topics

- driveMybox continues its international expansion: Hungary as a new strategic location

- Monesave introduces Socialised budgeting: Meet the app quietly revolutionising how users budget

- Digi Communications NV announces the release of the 2023 Preliminary Financial Results

- Digi Communications NV announces Investors Call for the presentation of the 2023 Preliminary Financial Results

- Lensa, един от най-ценените търговци на оптика в Румъния, пристига в България. Първият шоурум е открит в София

- Criando o futuro: desenvolvimento da AENO no mercado de consumo em Portugal

- Digi Communications N.V. Announces the release of the Financial Calendar for 2024

- Customer Data Platform Industry Attracts New Participants: CDP Institute Report

- eCarsTrade annonce Dirk Van Roost au poste de Directeur Administratif et Financier: une décision stratégique pour la croissance à venir

- BevZero Announces Strategic Partnership with TOMSA Desil to Distribute equipment for sustainability in the wine industry, as well as the development of Next-Gen Dealcoholization technology

- Digi Communications N.V. announces share transaction made by a Non-Executive Director of the Company with class B shares

- Digi Spain Telecom, the subsidiary of Digi Communications NV in Spain, has concluded a spectrum transfer agreement for the purchase of spectrum licenses

- Эксперт по торговле акциями Сергей Левин запускает онлайн-мастер-класс по торговле сырьевыми товарами и хеджированию

- Digi Communications N.V. announces the conclusion by Company’s Portuguese subsidiary of a framework agreement for spectrum usage rights

- North Texas Couple Completes Dream Purchase of Ouray’s Iconic Beaumont Hotel

- Предприниматель и филантроп Михаил Пелег подчеркнул важность саммита ООН по Целям устойчивого развития 2023 года в Нью-Йорке

- Digi Communications NV announces the release of the Q3 2023 Financial Results

- IQ Biozoom Innovates Non-Invasive Self-Testing, Empowering People to Self-Monitor with Laboratory Precision at Home

- BevZero Introduces Energy Saving Tank Insulation System to Europe under name “BevClad”

- Motorvision Group reduces localization costs using AI dubbing thanks to partnering with Dubformer

- Digi Communications NV Announces Investors Call for the Q3 2023 Financial Results

- Jifiti Granted Electronic Money Institution (EMI) License in Europe

- Предприниматель Михаил Пелег выступил в защиту образования и грамотности на мероприятии ЮНЕСКО, посвящённом Международному дню грамотности

- VRG Components Welcomes New Austrian Independent Agent

- Digi Communications N.V. announces that Digi Spain Telecom S.L.U., its subsidiary in Spain, and abrdn plc have completed the first investment within the transaction having as subject matter the financing of the roll out of a Fibre-to-the-Home (“FTTH”) network in Andalusia, Spain

- Продюсер Михаил Пелег, как сообщается, работает над новым сериалом с участием крупной голливудской актрисы

- Double digit growth in global hospitality industry for Q4 2023

- ITC Deploys Traffic Management Solution in Peachtree Corners, Launches into United States Market

- Cyviz onthult nieuwe TEMPEST dynamische controlekamer in Benelux, Nederland

- EU-Funded CommuniCity Launches its Second Open Call

- Astrologia pode dar pistas sobre a separação de Sophie Turner e Joe Jonas

- La astrología puede señalar las razones de la separación de Sophie Turner y Joe Jonas

- Empowering Europe against infectious diseases: innovative framework to tackle climate-driven health risks

- Montachem International Enters Compostable Materials Market with Seaweed Resins Company Loliware

- Digi Communications N.V. announces that its Belgian affiliated companies are moving ahead with their operations

- Digi Communications N.V. announces the exercise of conditional share options by an executive director of the Company, for the year 2022, as approved by the Company’s Ordinary General Shareholders’ Meeting from 18 May 2021

- Digi Communications N.V. announces the availability of the instruction regarding the payment of share dividend for the 2022 financial year

- Digi Communications N.V. announces the availability of the 2022 Annual Report

- Digi Communications N.V. announces the general shareholders’ meeting resolutions from 18 August 2023 approving amongst others, the 2022 Annual Accounts

- Русские эмигранты усиливают призывы «Я хочу, чтобы вы жили» через искусство

- BevZero Introduces State-of-the-Art Mobile Flash Pasteurization Unit to Enhance Non-Alcoholic Beverage Stability at South Africa Facility

- Russian Emigrés Amplify Pleas of “I Want You to Live” through Art

- Digi Communications NV announces the release of H1 2023 Financial Results

- Digi Communications NV Announces Investors Call for the H1 2023 Financial Results

- Digi Communications N.V. announces the convocation of the Company’s general shareholders meeting for 18 August 2023 for the approval of, among others, the 2022 Annual Report

- “Art Is Our Weapon”: Artists in Exile Deploy Their Talents in Support of Peace, Justice for Ukraine

- Digi Communications N.V. announces the availability of the 2022 Annual Financial Report

- “AmsEindShuttle” nuevo servicio de transporte que conecta el aeropuerto de Eindhoven y Ámsterdam

- Un nuovo servizio navetta “AmsEindShuttle” collega l’aeroporto di Eindhoven ad Amsterdam

- Digi Communications N.V. announces the conclusion of an amendment agreement to the Facility Agreement dated 26 July 2021, by the Company’s Spanish subsidiary

- Digi Communications N.V. announces an amendment of the Company’s 2023 financial calendar

- iGulu F1: Brewing Evolution Unleashed

- Почему интерактивная «Карта мира» собрала ключевые антивоенные сообщества россиян по всему миру и становится для них важнейшим инструментом

- Hajj Minister meets EU ambassadors to Saudi Arabia

- Online Organizing Platform “Map of Peace” Emerges as Key Tool for Diaspora Activists

- Digi Communications N.V. announces that conditional stock options were granted to executive directors of the Company based on the general shareholders’ meeting approval from 18 May 2021

- Digi Communications N.V. announces the release of the Q1 2023 financial results

- AMBROSIA – A MULTIPLEXED PLASMO-PHOTONIC BIOSENSING PLATFORM FOR RAPID AND INTELLIGENT SEPSIS DIAGNOSIS AT THE POINT-OF-CARE

- Digi Communications NV announces Investors Call for the Q1 2023 Financial Results presentation

- Digi Communications N.V. announces the amendment of the Company’s 2023 financial calendar

- Digi Communications N.V. announces the conclusion of two Facilities Agreements by the Company’s Romanian subsidiary

- Digi Communications N.V. announces the conclusion of a Senior Facility Agreement by the Company’s Romanian subsidiary

- Patients as Partners Europe Returns to London and Announces Agenda Highlights

- GRETE PROJECT RESULTS PRESENTED TO TEXTILE INDUSTRY STAKEHOLDERS AT INTERNATIONAL CELLULOSE FIBRES CONFERENCE

- Digi Communications N.V. announces Digi Spain Telecom S.L.U., its subsidiary in Spain, entered into an investment agreement with abrdn to finance the roll out of a Fibre-to-the-Home (FTTH) network in Andalusia, Spain

- XSpline SPA / University of Linz (Austria): the first patient has been enrolled in the international multicenter clinical study for the Cardiac Resynchronization Therapy DeliveRy guided by non-Invasive electrical and VEnous anatomy assessment (CRT-DRIVE)

- Franklin Junction Expands Host Kitchen® Network To Europe with Digital Food Hall Pioneer Casper

- Unihertz a dévoilé un nouveau smartphone distinctif, Luna, au MWC 2023 de Barcelone

- Unihertz Brachte ein Neues, Markantes Smartphone, Luna, auf dem MWC 2023 in Barcelona

- Digi Communications N.V. announces conditional stock options granted to a Director of the Company based on the general shareholders’ meeting approval from 28 December 2022

- Digi Communications N.V. announces the release of the 2022 Preliminary Financial Results

- CAMPAIGNS FOR HUMANITY: MARKETING AGENCY ANNOUNCES €10,000 AWARDS FOR RUSSIANS SUPPORTING UKRAINE

- One Year Since the Invasion: New Series Highlights Everyday People Transformed by War into Heroes

- Digi Communications N.V. announces Investors Call for the presentation of the 2022 Preliminary Financial Results

- BevZero Receives Top Environmental Certification

- Thompson Duke Industrial Attains CE Certification for its Cannabis Vaporizer Cartridge Filling Equipment

- Modern Media Hub Takes Huge Leap with Financing Help of Cap Expand Partners

- Digi Communications N.V. announces the release of the Financial Calendar for 2023

- Digi Communications N.V. announces the exercise of stock options by two of the Directors of the Company

- Tanduay Is First Asian Rum to Enter Austrian Market

- Digi Communications N.V. Announces the Resolutions of the General Shareholders’ Meeting from 28 December 2022, approving, amongst others, the 2021 Annual Accounts

- MIGUN LIFE's new personal healthcare products are unveiled, heralding the grand first debut at CES 2023

- Digi Communications N.V. announces that the Romanian version of the Annual Financial Report for the year ended December 31, 2021 for the Digi Communications N.V. Group is available

- Digi Communications N.V. Announces Convocation of the Company’s general shareholders meeting for 28 December 2022 for the approval of, among other items, the 2021 Annual Report

- Digi Communications N.V. Announces the availability of the Annual Financial Report for the year ended December 31, 2021 for Digi Communications N.V. Group

- Digi Communications N.V.’s Romanian subsidiary was designated winner of the auction organised for the allocation of certain radio frequency entitlements in 2600 MHz and 3400-3800 MHz bands

- Digi Communications NV announces the release of the Q3 2022 Financial Results

- Digi Communications N.V. announces a Subsequent Amendment of the Company’s 2022 financial calendar

- Digi Communications NV announces Investors Call for the Q3 2022 Financial Results presentation

- Sygnum Bank and Artemundi tokenize Warhol’s Marilyn Monroe artwork

- Your Daily Commutes Will be Seamless, Connected and Productive.

- The secondary market platform THELAPHANT.IO introduces, for the first time in Israel: "a stock liquidity plan" for high-tech employees and companies

- Teavaro and CDP Institute Offer Free Online Course on Identity Resolution

- Digi Communications N.V. announces a Subsequent Amendment of the Company’s 2022 financial calendar

- Digi Communications N.V. announces an Amendment of the Company’s 2022 financial calendar

- 12-month real-world achievements for Diabeloop’s Automated Insulin Delivery (AID):

- Digi Communications N.V. announces the availability of the Instruction regarding the Payment of Dividends for the Financial Year 2021

- Simplify Content za usluge organskog Content Marketinga otvara svoja vrata poduzećima da (zajedno) uspješno kreiraju kvalitetan i relevantan sadržaj za potencijalne i postojeće klijente

- Digi Communications N.V. announces the approval of interim dividend distribution and updates regarding the 2022 Financial Calendar

- A new, creativity-based educational method increases the ability to solve problems with young people, in the social field, or when building a team in the company

- Digi Communications NV announces the release of the H1 2022 Financial Results

- Mit Intelligenz geladen

- Digi Communications NV announces Investors Call for the H1 2022 Financial Results

- Digi Communications N.V. Announces the update of its 2022 Financial Calendar

- Digi Communications N.V. Announces the conclusion by the Company’s Spanish subsidiary of an amendment agreement to the facility agreement dated 26 July 2021

- Customer Data Platform Industry Grew Strongly in First Half of 2022: CDP Institute Report

- Metadeq Announces Breakthrough Non-Invasive Blood Test that Solves NASH Diagnosis Problem

- Η HBC Consulting Expert θεωρεί παράλογη την εμπλοκή του κυπριακού δικαστηρίου στην υπόθεση κληρονομιάς από τη χήρα του ολιγάρχη Μπόσοφ

- Esperto della società di consulenza HBC: le autorità italiane non hanno permesso a Katerina Bosov di vendere la villa del marito

- HBC Consulting Expert considers senseless the involvement of the Cypriot court in the case of inheritance by the widow of oligarch Bosov

- Fusion BPO Services is Opening New Center in Kosovo

- Hi-SIDE demonstrates an integrated high speed satellite data chain architecture at data rates exceeding 10 Gigabits per second

- Digi Communications N.V. announces that a joint venture of its subsidiary in Romania designated as one of the winners of the auction organized by the Belgian Institute for Postal Services and Telecommunications for the allocation of mobile spectrum frequency user rights

- KI-basierte Geldanlage für Privatpersonen – Velvet AutoInvest erhält 1,3 Mio. USD Seed-Investment

- Haizol Now Offer 3D Printing Services to Customers Worldwide

- Caravel Capital Fund Showcased At Secure Spectrum’s Hedge Fund Seminar

- Diabeloop, a key player in therapeutic AI applied to insulin delivery, announces 70 million euros new financing round to accelerate its international expansion

- Digi Communications NV Announces Availability of the 2021 Preliminary Annual Report (including the Company’s audited non-statutory Consolidated financial statements issued as per IFRS EU)

- Digi Communications N.V. Announces that conditional stock options were granted to executive directors of the Company and to directors and employees of the Company’s Romanian Subsidiary

- Caravel Capital Investments Inc. Founding Partner to Speak at Secure Spectrum Hedge Fund Seminar

- Digi Communications NV announces a correction of clerical errors by Amending the Q1 2022 Financial Report

- Digi Communications NV announces the release of Q1 2022 Financial Results

- Digi Communications N.V. announces Investors Call for the Q1 2022 Financial Results presentation

- Yield Crowd Tokenizes US $50M Real Estate Portfolio on Stellar Blockchain

- Digi Communications N.V. Announces an Amendment to the Financial Calendar for 2022

- Diabeloop presents new real-life results of DBLG1® System: Confirmed improvement in Time In Range +18.4 percentage points; Reduction of time spent in hypoglycemia to only 0.9%

- How two female entrepreneurs are redefining the lake travel industry

- Vil du være med å utvikle fremtidens bærekraftige reiseliv?

- Mettiti alla prova con la terza edizione del CASSINI Hackathon per rivitalizzare il settore turistico

- Προκαλέστε τον εαυτό σας στο 3ο CASSINI Hackathon και στοχεύστε την αναζωογόνηση του τουρισμού!

- Participez au 3e Hackathon CASSINI et relevez le défi de redynamiser le tourisme!

- 3. CASSINI Hackathon zur Neubelebung des Tourismus: Stellen Sie sich der Herausforderung!

- Írd újra Európa turizmusát a 3. CASSINI Hackathonon!

- Aceita o desafio do 3º CASSINI Hackathon para revitalizar o turismo!

- Podejmij wyzwanie! Weź udział w 3. Hackathonie CASSINI i pomóż ponownie ożywić turystykę!

- Daag jezelf uit op de 3e CASSINI Hackathon en blaas toerisme nieuw leven in

- Diabeloop adapts its self-learning, personalized insulin automatization software to be used with insulin pens

- Amadeus unveils five defining trends for the US group travel and events industry in 2022

- On World Bipolar Day ALCEDIAG announces EIT Health supported EDIT-B Consortium validating innovative blood diagnostic test for bipolar disorder

- Global & Europe Mental Health Software and Devices Market to Witness a Revenue of USD 13367.12 Million by 2030 by Growing with a CAGR of 13.28% During 2021-2030; Increasing Concern for Mental Health Disorders to Drive Market Growth

- Digi Communications NV announces the release of the 2021 Preliminary Financial Results

- Digi Communications NV announces Investors Call for the 2021 Preliminary Financial Results presentation

- At MWC in Barcelona, Amphenol will be exhibiting its wide offering for wireless service providers – including Open RAN compatible active 5G antennas

- ELIOS combined with cataract surgery delivers significant IOP reduction out to 8 years

- Tableau comparatif des pays : les caractéristiques à connaître avant de se développer à l’international

- Smart exosomes from an Australian technology leader

- Bucharest Digi Communications N.V. announces Share transaction made by an executive director of the Company with class B shares

- Transmetrics AI is Applied by DB Schenker to Improve Land Transport Network in Bulgaria

- Digi Communications N.V.: Announces repayment of an aggregate amount of approx. EUR 272 million of the Group’s financial debt

- El Liceo Europeo vence el Premio Zayed a la Sustentabilidad 2022 en Europa y Asia Central

- Framework rebrands to daappa, heralding a new phase in fintech solutions designed for private markets

- Digi Communications N.V. Announces the publishing of the Financial Calendar for 2022

- Manufacturing giant Haizol expands their offices in China

- Patients and R&D Leaders Jointly Present at EU Conference on Progress with Patient-Input to Transform Medicine Development

- Seminário Bíblico sobre “O Cumprimento da Palavra de Jesus no Mundo de Hoje”

- 'I Love fruit & veg from Europe': Weihnachten in der Schweiz ist gesund und voller Aromen

- Fidupar Now Live on Framework’s Core Solution

- Maya Miranda Ambarsari launches InterconnectDATA information platform for authentic data

- Digi Communications N.V. Announces that the offer of the Company’s Romanian subsidiary was designated winner of the auction organised for the allocation of certain radio frecquency entitlements

- New dating site aimed at people with mental health problems launches in Switzerland

- BITSCore Tests Satellite Cyber-Security and Ride-Share Algorithms on Australian Rocket

- StatusMatch.com ed Emirates collaborano per aiutare i frequenti viaggiatori italiani a tornare in volo

- StatusMatch.com and Emirates partner up to help Italian frequent flyers get back in the air

- MinDCet drivers and FTEX powertrain solutions enable EV GaN applications

- Digi Communications NV announces the release of the Q3 2021 Financial Results

- Origami and citoQualis Team up for Startups

- Digi Communications NV announces Investors Call for the Q3 Financial Results presentation

- Digi Communications N.V. announces the extraordinary general meeting’s resolution from 4 November 2021, approving the appointment of KPMG N.V. as the Company’s statutory auditor for the 2021 financial year

- Digi Communications N.V. announces The solution reached by the Bucharest Court of Appeal regarding the investigation conducted by the Romanian National Anticorruption Directorate with respect to RCS & RDS S.A., Integrasoft S.R.L. and certain of their directors

- Digi Communications N.V. Announces the results of the auction organised by the Portuguese Authority for Telecommunications

- Haizol expands its capabilities to include component assembly and product development

- EIC, the World’s Largest Multinational Innovation Program, to Invest €13.4M in Wi-Charge, a Game Changing Wireless Power Company

- European Weightlifting Federation on its way for Electoral Congress

- “Without women, We are unable to solve the world’s greatest challenges” — She Loves Tech 12 Hot Finalists ready to get their chance at the Local Pitch in South Europe!

- Significant improvement in increasing Time In Range and reducing hypoglycemia among people equipped with Diabeloop DBLG1

- Digi Communications N.V. Announces the Convocation of the Company’s Extraordinary General Meeting of Shareholders on 4 November 2021 in order to appoint KPMG N.V. as the Company’s new statutory auditor for the financial year 2021

- Unit of Measure enters partnership with Stibo Systems

- Haizol, metal manufacturing giant, launch a brand new website which is both user friendly and interactive

- Groundbreaking Immersive Experience from Samsung and Artist Michael Murphy Reveals a New Perspective for Visual Entertainment Through the Stunningly Slim Neo QLED TV

- Collaboration between Airbus and Neural Concept

- Archpriest Nikolay Balashov on Patriarch Bartholomew’s speeches in Kiev

- ABB's Peter Voser joins Xynteo's Europe Delivers partnership as it new Chairman

- Digi Communications NV announces that a new stock option programme was approved

- Leverage the benefits of digital manufacturing with Haizol

- Digi Communications NV announces the release of the H1 2021 Financial Results

- Digi Communications NV announces Investors Call on the Financial Results for H1 2021

- Rockegitarist-Sensasjon Rocky Kramer Har Fått Hovedrollen I Mutt Productions Filmen Rockin’ In Time

- Dispatch.d Offers Unique US Market Entry Services for European Impact Brands

- CSA Research’s New Localization Intelligence Analyzer, powered by LocHub, Helps Organizations Improve their Website’s Effectiveness for Global Customers

- Customer Data Platform Industry Accelerated During Pandemic: CDP Institute Report

- Digi Communications N.V. announces that two of its subsidiaries entered into two facility agreements

- Introducing Cap Expand Partners, Helping Business Leaders Break International Barriers

- Hong Kong’s Innovation and Technology Venture Fund Becomes Strategic Financial Investor of Ignatica

- Cure for prostate cancer on the horizon

- Fanpictor signs multi-year partnership with Royal Belgian Football Association

- Fanpictor unterzeichnet mehrjährige Partnerschaft mit dem Königlich Belgischen Fussballverband

- Fanpictor signe un partenariat pluriannuel avec la Royal Belgian Football Association

- Fanpictor firma una colaboración de varios años con la Real Federación Belga de Fútbol

- Fanpictor firma una partnership pluriennale con la Royal Belgian Football Association

- Fanpictor tekent meerjarige partnership met Koninklijke Belgische Voetbalbond

- Launch of the New Akenza Platform

- De zelflerende algoritme DBLG1®: eenvoudig te gebruiken voor een optimale en gepersonaliseerde behandeling van diabetes type 1

- Launch of the Anna Lindh Foundation Virtual Marathon for Dialogue!

- Digi Communications N.V. announces the exercise of stock options by the Executive Director of the Company pursuant to the decision of the Company’s general meeting of shareholders dated 30 April 2020 and in accordance with the stock option plan approved at the level of the Company in 2017

- New research unlocks long tail growth opportunity for the tech industry

- Digi Communications NV announces the availability of the instructions on the 2020 share dividend payment

- Digi Communications NV announces that conditional stock options were granted to several Directors of the Company based on the approval of the general meeting of shareholders from 18 May 2021

- Digi Communications N.V. Announces the Company’s General Shareholders Meeting resolutions adopted on 18 May 2021 approving, amongst others, the 2020 Annual Accounts

- Digi Communications N.V. (“Digi”) announces the Q1 2021 Financial results

- Digi Communications NV announces Investors Call for the Q1 2021 Financial Results

- Digi Communications N.V. announces an Amendment to the 2021 Financial Calendar

- Fastpayhotels Hits an Industry Milestone by Connecting 500 Hotels Per Day Through DerbySoft Technology

- 4 ways to build a more flexible supply chain

- Join the world's leading virtual CBD event for FREE

- DEEPENING STRATEGIC RELATIONSHIP BETWEEN UBC AND PIONEERING DECENTRALISED PLATFORM, MANYONE

- Mono Solutions recognizes Norwegian small business agency with best website 2021 award

- Mono Solutions and Xrysos Odigos unlock new opportunities for small businesses

- Behind the scenes of a 10,000-people online conference: creating a live-event atmosphere and leveraging cybersecurity software

- Largest Supply Chain for Face masks, FFP2, FFP3 and cloth masks

- TRANSMAR AND TRANSMETRICS SIGN DEAL FOR STATE-OF-THE-ART LOGISTICS COLLABORATION

- Amendment of Digi Communications N.V. Financial Calendar for 2021

- 4iG and Digi Communications NV’s Romanian subsidiary have entered into a term sheet with regards to a potential acquisition by 4iG of DIGI Group’s Hungarian operations

- “Building Healthy Relationships and Enhancing Gender Equality”: Young women from Cyprus, Egypt, Lebanon and Jordan come together

- Bring Ventures investit dans Crossborderit (CBIT), DDP et une solution de commerce électronique

- Bring Ventures investiert in Crossborderit (CBIT), eine DDP (geliefert verzollt) und E-Commerce Lösung

- Bring Ventures invests in Crossborderit (CBIT), DDP and ecommerce solution

- Lionspeed GP with Patrick Kolb and Lorenzo Rocco joins forces with CarCollection Motorsport in 2021

- Eurekos, ein klassenbester LMS-Anbieter, hat seine Position im renommierten Fosway 9-Grid™ für Lernsysteme verbessert

- Eurekos, en førsteklasses LMS-udbyder, har forstærket sin position på den prestigefyldte Fosway 9-Grid™ for læringssystemer

- Eurekos, ein erstklassiger LMS-Anbieter, hat seine Position auf dem renommierten Fosway 9-Grid™ für Lernsysteme weiter ausgebaut

- Digi Communications N.V. announces Share transaction made by an executive director of the Company with class B shares

- Digi Communications N.V.: Announces an Amendment to the Financial Calendar for 2021

- Ideanomics Invests $13M in Italian EV Motorcycle Company, Energica

- DigiSky and Asman Technology Announce Global Reseller Agreement

- Neowintech - O Marketplace Da Sua Próxima Solução Financeira

- Neowintech - Il Marketplace per la tua prossima soluzione finanziaria

- PIONEERING DECENTRALISED SECURE MESSAGING PLATFORM MANYONE ANNOUNCES STRATEGIC RELATIONSHIP WITH UNIVERSITY COLLEGE LONDON CENTRE BLOCKCHAIN TECHNOLOGY

- Digi Communications NV announces the release of the 2020 Preliminary Financial Results

- Fraunhofer IGD develops automated robotic arm to scan cultural objects in 3D, now cooperating with Phase One

- Adapt Fast or Disappear – Choosing the Right Supplier

- Digi Communications NV announces Investors Call for the 2020 Preliminary Financial Results

- A URSAPHARM Arzneimittel e a CEBINA anunciam uma parceria com vista a reaproveitar o anti-histamínico azelastina para combater a COVID-19

- URSAPHARM Arzneimittel et CEBINA annoncent un partenariat pour reconvertir l'antihistaminique azélastine afin de lutter contre la COVID-19

- URSAPHARM Arzneimittel y CEBINA anuncian una colaboración para readaptar el antihistamínico azelastine para combatir la COVID-19

- URSAPHARM Arzneimittel and CEBINA announce partnership to repurpose the antihistamine azelastine to combat COVID-19

- ANIL UZUN Will Launch Bass Guitar Lessons Series on Youtube

- Henrik Stampe Appointed CEO for Mono Solutions

- Anna Mossberg leder Nordens största privata AI-lab i Sverige: "Utan AI riskerar svenska företag att förlora sin konkurrensfördel."

- What COVID-19 has taught us about manufacturing & the importance of a digital online marketplace

- Digi Communications N.V. announces: the Supreme Court of Hungary dismissed the Company’s appeal related to the 5G Tender procedure

- Customer Data Platform Industry to Reach $1.5 Billion in 2021: CDP Institute Report

- Editor's pick archive....

GreenMantra Technologies Announces Exclusive Distribution Relationship with HARKE GROUP